Mantra price has gone parabolic since 2024, becoming one of the best-performing players in the crypto industry.

Mantra (OM), which hopes to become the biggest crypto in the real world asset or RWA industry, has soared from $0.0158 in January 2024 to $9.10. This surge has moved its market cap from $29 million in January 2024 to $8.45 billion today.

Mantra has jumped after launching MantraChain in 2024. MantraChain hopes to become the biggest layer 1 network for the RWA industry. Last week, the developers launched RWAccelerator, which they hope to fund developers in the industry.

Mantra also owns MANTRA Zone, a gateway to the chain, where users complete onchain missions and boost reward allocations. These users receive regular airdrops, which helps them boost their income, especially now that the OM price is surging.

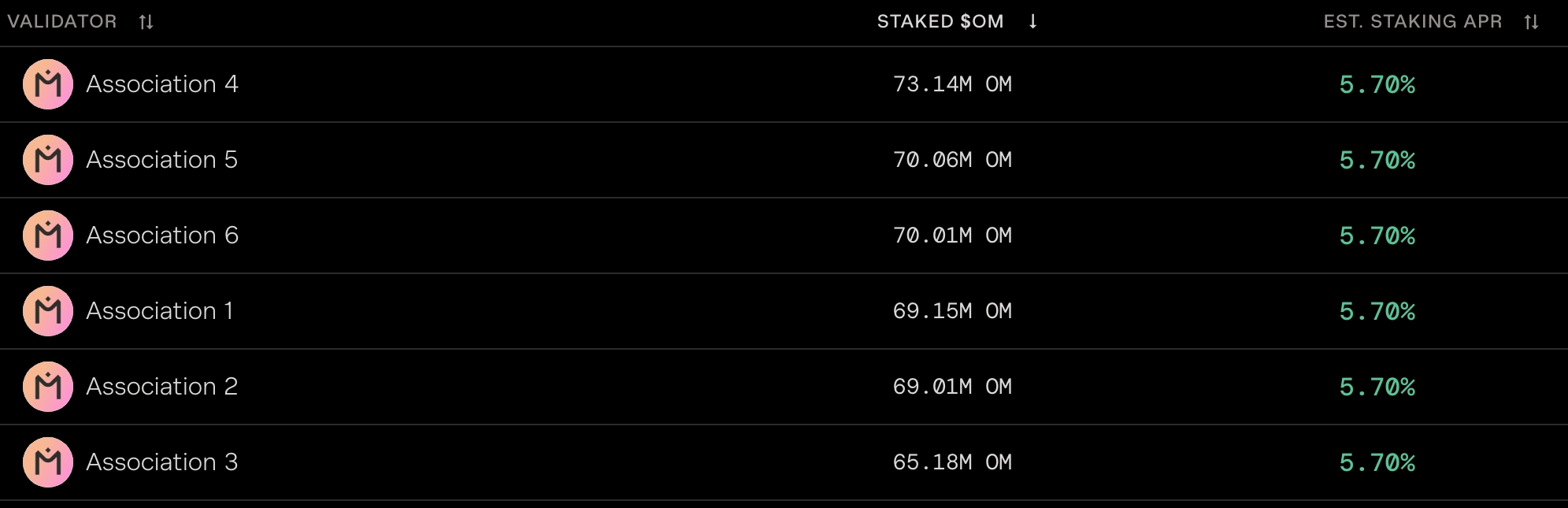

Mantra price has also roared because of its strong staking rewards, which are higher than other networks like Ethereum (ETH) and Near Protocol (NEAR). Most OM validators pay an average staking yield of 5.50%.

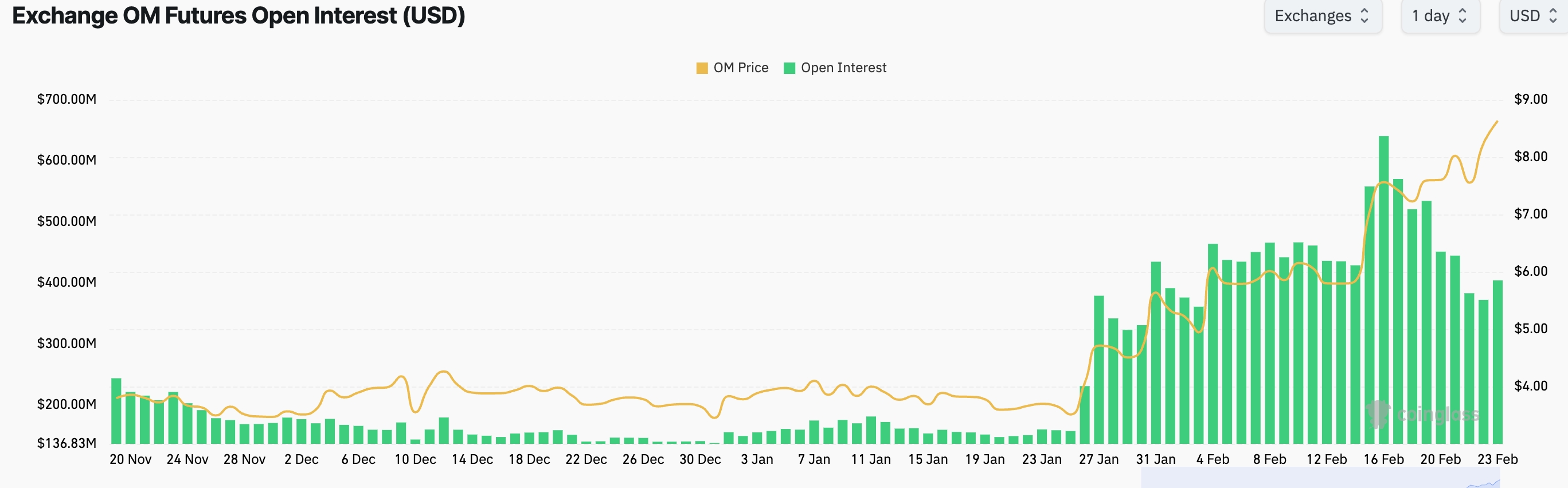

There are a few reasons why the OM price will reverse soon. First, there is an ongoing divergence between Mantra and the futures open interest.

As shown below, Coinglass data shows that the futures interest peaked at $640 million early this month, and has dropped to $404 million. That divergence is a sign that investors in the futures market are paring back their bets on the coin.

Mantra price technicals point to a retreat

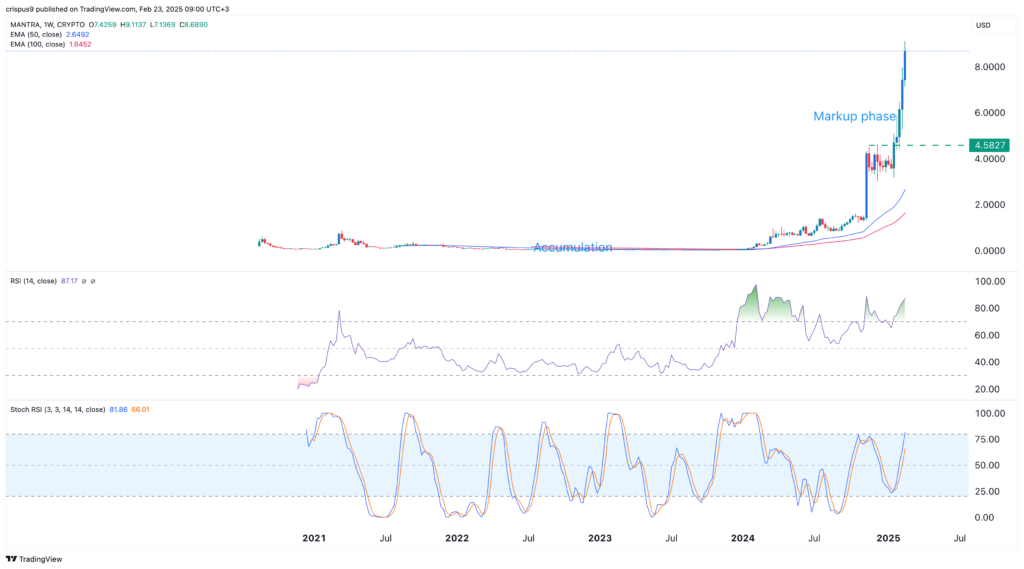

Second, the OM price may retreat because of the concept of mean reversion. This is a concept that states that an asset will always return to its historical averages now that it has deviated significantly from them.

For example, the 50-week moving average is at $2.65, while the 100-day average is at $1.64. In this case, the mean reversion concept hints that the price will move back to these averages over time.

Third, Mantra price is still in the markup phase of the Wyckoff Method. The chart above shows that it remained in a consolidation phase between 2020 and 2024. This consolidation was part of the accumulation.

It then entered the markup phase in 2024, which is now going on. This phase is usually followed by the distribution and then markdown where an asset retreats.

Fourth, there are signs that the Mantra token is getting overbought. The Relative Strength Index has moved to the extreme overbought point at 87, while the Stochastic RSI is nearing the overbought level. These are signs that the momentum may start waning.

Therefore, there is a likelihood that the Mantra price may drop, at least to the next key support level at $4.58, its highest swing on Dec. 9.

Mantra: From DeFi to tokenized assets

Launched in 2020 by John Patrick Mullin, Will Corkin, and Rodrigo Quan Miranda, the project initially gained traction as Mantra DAO, emphasizing community-driven governance and cross-chain interoperability.

Originally built on Polkadot’s Substrate framework, Mantra has expanded across multiple blockchain networks, including Ethereum and Binance Smart Chain. It offers users opportunities to stake OM tokens, earn yield, and participate in lending and borrowing markets.

Recently, Mantra has pivoted toward regulated financial services, securing a Virtual Asset Service Provider (VASP) license in Abu Dhabi. This move positions it as a leader in tokenizing real-world assets, bridging the gap between traditional finance (TradFi) and DeFi.

By integrating RWAs like real estate and financial instruments, Mantra is pioneering compliant and scalable blockchain solutions.