New research by Dragonfly Capital reveals that U.S. users may have missed out on as much as $5.02 billion in potential revenue from geo-blocked airdrops.

Back in the early days, before the crypto industry got overcrowded with grief memecoin pseudonymous creators, blockchain developers came up with a way to reward users for supporting and growing projects. That method became known as the airdrop.

Airdrops allowed projects to drum up early interest by encouraging engagement — like interacting with a protocol by sending to it on-chain transactions — or to retroactively reward users of blockchain products. Sometimes, these airdrops turned out to be highly lucrative for the most active supporters. Sometimes, they weren’t. One way or the other, airdrops eventually became too big to ignore, so they ran into political roadblocks, shutting out U.S. users.

Now, data from Californian venture firm Dragonfly Capital shows that geoblocking may have cost crypto addresses linked to U.S. users billions of dollars, as fearing regulatory crackdowns from U.S. watchdogs, many blockchain startups decided to block access for them altogether.

Billions in missed out opportunities

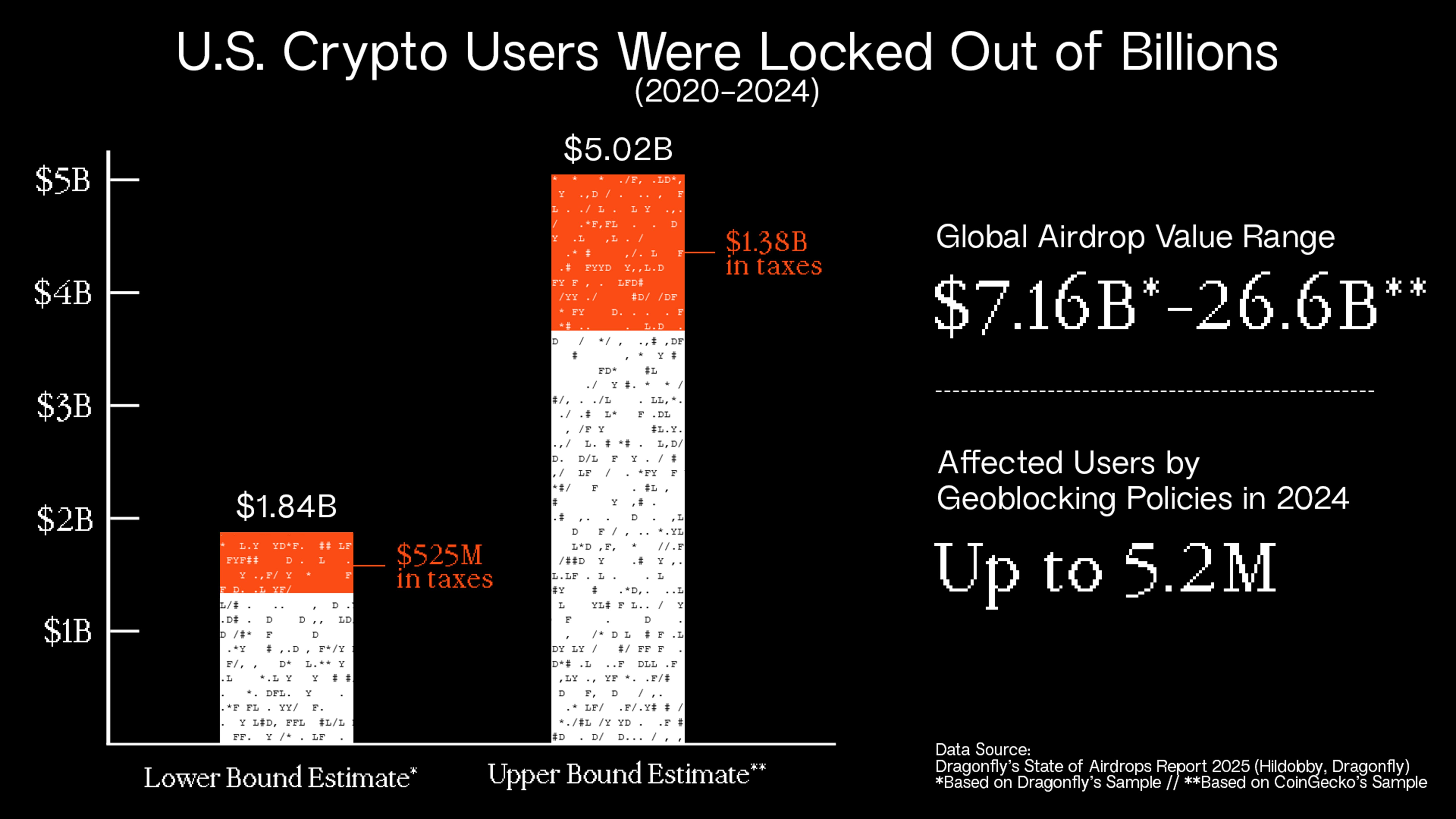

Of an estimated 18.4 to 52.3 million crypto holders in the U.S., between 920,000 and 5.2 million active users were affected by geoblocking in 2024 alone, the data shows. Dragonfly Capital estimates that 22-24% of all active crypto addresses worldwide belong to U.S. residents, many of whom have been excluded from airdrop participation.

“[…] the current regulatory landscape in the United States, with its focus on enforcement and lack of tailored frameworks, has created significant challenges for projects seeking to utilize this mechanism effectively.”

Dragonfly Capital

In a commentary on crypto.news, Dragonfly Capital’s legal counsel Jessica Furr noted that there’s a “clear change in the regulatory winds in the U.S.,” adding that the firm has seen a “shift in the stance of agencies and an invitation for open dialogue, which is promising.”

“That said, policy changes are never linear — they ebb and flow, making it hard to predict exactly when we’ll see concrete action. In terms of legislation passing, the present conditions are the most favorable we’ve seen for some time. So, we’re optimistic we’ll see some movement.”

Jessica Furr

A sample of 11 blockchain projects analyzed by the venture capital firm generated approximately $7.16 billion in total value, with around 1.9 million claimers worldwide. The average median claim per eligible address in this dataset was $4,600.

However, due to regulatory concerns, many projects chose to block U.S. users from participating. As a result, U.S. residents are estimated to have missed out on $1.84 billion to $2.64 billion in potential airdrop revenue between 2020 and 2024.

The report also points to a sharp drop in the share of active addresses and crypto developers in the Americas since 2015 — falling from 31% and 45% back then to 22% and 24% in 2024. Dragonfly Capital data scientist Hildobby says the decline likely has multiple causes.

“You have seen some people leave crypto frustrated by the current regulatory conditions and the promise of AI, but perhaps more significantly, there’s likely a rise in the number of non-U.S. developers entering the space.”

Hildobby

Furr says the U.S. should “nurture this nascent industry” rather than drive talent abroad if it wants to stay ahead.

Looking at a broader dataset, a CoinGecko report reviewing 50 airdrops found that approximately $26.6 billion in total value has been distributed globally. Using CoinGecko’s figures alongside Dragonfly Capital’s calculations, the estimated total revenue lost to U.S. users due to geoblocking could range from $3.49 billion to $5.02 billion across 21 projects.

Tax revenue losses

Beyond individual losses, the U.S. government also appears to be missing out on substantial tax revenue. Based on lost airdrop income ranging from $1.9 billion to $5.02 billion between 2020 and 2024, federal tax revenue losses are estimated at $418 million to $1.1 billion, Dragonfly Capital reveals.

State tax revenue losses could add another $107 million to $284 million, bringing the total estimated tax revenue loss to between $525 million and $1.38 billion over the period.

Offshore migration

Regulatory uncertainty has also driven major crypto firms offshore, further reducing U.S. tax revenue. A prime example is Tether, the issuer of the (USDT) stablecoin, which is incorporated in the British Virgin Islands.

In 2024, Tether reported a $6.2 billion profit, surpassing even financial giant BlackRock. If Tether were headquartered in the U.S. and subject to federal and state corporate taxes, it would have owed approximately $1.3 billion in federal taxes (at a 21% corporate tax rate) and $316 million in state taxes (at an average 5.1% state tax rate).

In total, the U.S. is potentially missing out on $1.6 billion annually in tax revenue from Tether alone. The absence of crypto firms like Tether also means lost payroll taxes, local business taxes, and income tax revenue from employees — further compounding the economic impact.

Given that Tether is just one of many high-revenue firms operating offshore, the cumulative effect of these corporate relocations represents a massive lost opportunity for the U.S. government, Dragonfly Capital concludes.