Made handsome profits in your crypto trades? Oh wait, do not forget to pay your taxes before you receive notice from tax agencies on the gains you made from crypto transactions. We can do crypto investing with a few clicks, but what about maintaining records and transaction history?

Calculating the gain and loss for each transaction manually can be a very tedious task. In this article, we shall cover the 5 best crypto tax software which is used and generates tax reports.

| Platform | No. of transactions supported | No. of Exchanges for auto-sync | Subscription Plan | Multiple Tax Reports supported |

|---|---|---|---|---|

| Koinly | 10,000+ | 354+ | Starts from $49+ | Yes |

| CoinTracking | 100,000+ | 400+ | Starts from $10+ | Yes |

| Zenledger | 15,000+ | 400+ | Starts from $49+ | No |

| Accointing | 50,000+ | 300+ | Starts from $79+ | Yes |

| Token Tax | 30,000+ and above with additional charges | All exchanges | Starts from $65+ | Yes |

| Bear Tax | 1 million+ | 40+ | Starts from $49+ | Yes |

1st Best Crypto Tax Software in the USA: Koinly

One of the best crypto tax software platforms that provide seamless integration amongst multiple exchanges, wallets, blockchain addresses, and services to have a complete view of crypto transactions and portfolios in one place.

Also read, Koinly Review – Is It Really a Good Tax Software?

Features:

- Gives customized tax reports for 20+ countries including the US, Sweden, Germany, UK, Canada

- Supports 354+ exchanges, 74+ wallets, 14 blockchain addresses, 17000+ cryptocurrencies the highest supported by any crypto tax software, and 11 services including Nexo, BlockFi, Paxful, etc.

- Automatically syncs data, i.e. import via API, x/y/z pub keys, and CSV file upload as well.

- Displays real-time portfolio value along with tax liabilities to be paid. Offers income overview across staking, mining, trading, lending, and other crypto income. Gives Profit & Loss and capital gains statement along with realized and unrealized gains breakup.

- Preview of Tax reports is free on the platform, one needs to pay while downloading the reports. One can download reports like IRS Report (Form 8949 & Schedule D).

- Directly export your transactions to TurboTax, TaxAct, and H&R to pay and file taxes online.

Also, read CoinTracking vs Koinly: Simplify Your Crypto Taxes

Pricing:

- Free: Preview details for up to 10,000 transactions and pay when you want to download reports.

- Newbie: $49 for up to 100 transactions.

- Hodler: $99 for up to 1000 transactions.

- Trader: $179 for 10,000+ transactions.

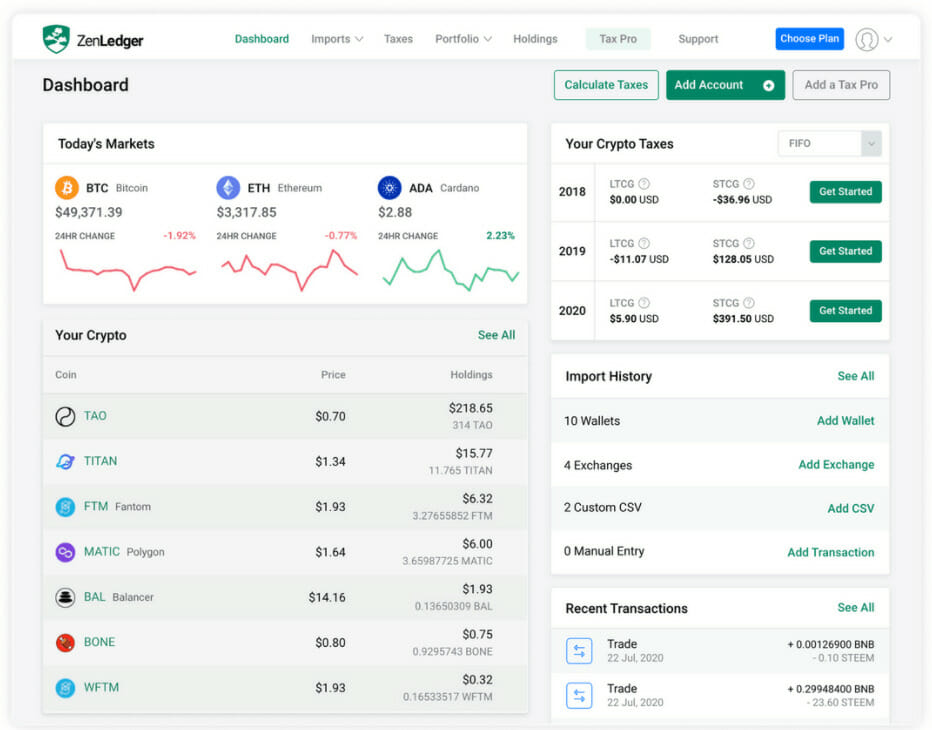

2nd Best Crypto Tax Software in the USA: ZenLedger

ZenLedger has the highest number of integrations via APIs and also supports Defi & NFTs. However, the only issue is it allows for tax calculation of a person liable to pay taxes only in the USA.

Features:

- Crypto tax-loss harvesting tools.

- Grand Unified Accounting- Previews the entire transaction history across wallets and exchanges in the readable spreadsheet.

- Plans available with Tax consultant services to guide and file tax returns.

- Supports 400+ exchanges, 40+ blockchains & 20+ Defi projects.

- On-demand customer service team for free & paid plans.

- Supports for US tax compliance users.

Pricing:

- Free Plan: Track up to 25 transactions and allows detailed report of them. This plan would work for crypto holders than traders. However, no details regarding Defi, Staking, NFTs shall be available.

- Starter Plan: Track up to 100 transactions for $49.

- Premium Plan: Track up to 5,000 transactions for $149.

- Executive: Tracks up to 15,000 transactions for $399.

- Platinum: Track unlimited transactions and calculate taxes, additionally a dedicated RM is assigned in this plan for $999.

Prepared Plans (Tax Professionals): In this plan, get a dedicated tax professional to help you calculate your tax liabilities and pay off them.

- Consultation: $195 for a 30-minute consultation.

- Single-year tax report starts at $3500.

- Multi-year tax report plan starts at $6500.

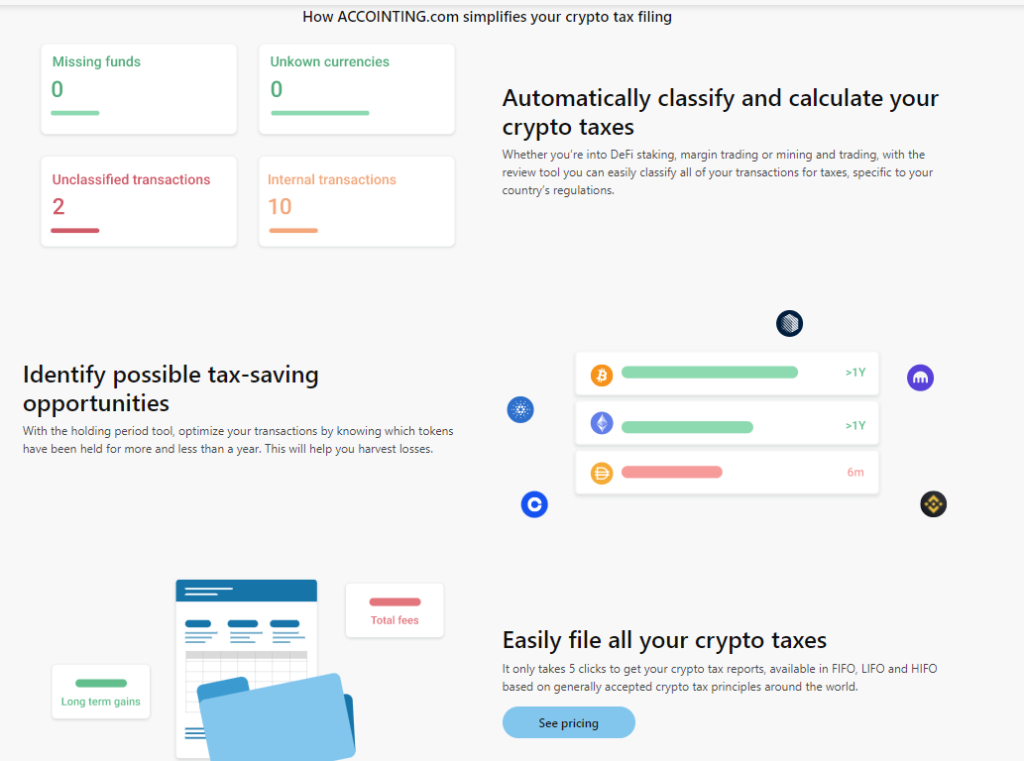

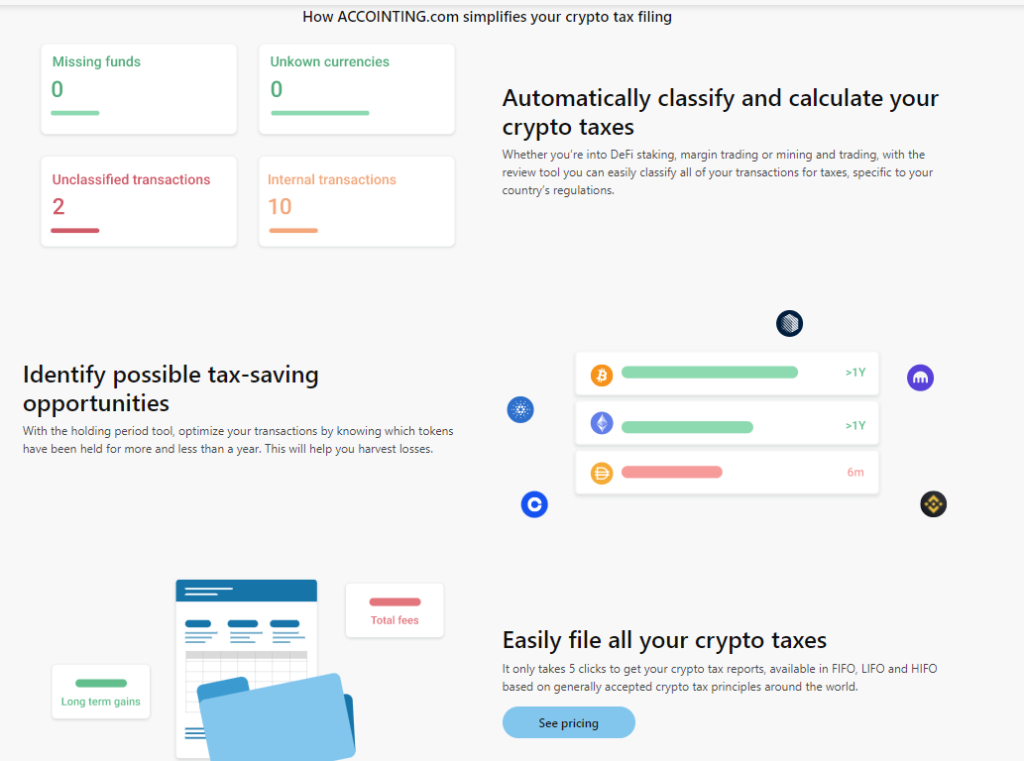

3rd Best Crypto Tax Software in the USA: Accointing

Offers a web version and a mobile application with multiple integrations to auto-sync the portfolio transactions. Offer a special feature of Trading Tax Optimizer (TTO) which helps you reduce and optimize your overall taxes.

Also read, Accointing Review – A Complete Crypto Tax solution

Features:

- Tax reports for multi-countries depending on their specific tax laws.

- Multiple integrations via APIs and CSV files.

- Automatically categorizes transactions as missing funds, unknown currencies, unclassified transactions, and internal transactions.

- The TTO feature allows you to set your tax goal as reducing tax liability, optimizing .taxes, or harvesting losses across the transactions and achieve the goal.

- Supports up to 50,000 transactions.

Pricing:

- Freemium plans for up to 25 transactions in a year. Currently, the TTO feature is also available in the free plan.

- Hobbyist: $79 for tracking taxes on 500 transactions.

- Trader: $199 for tracking taxes on 5,000 transactions.

- Pro: $299 for tracking taxes on 50,000 transactions.

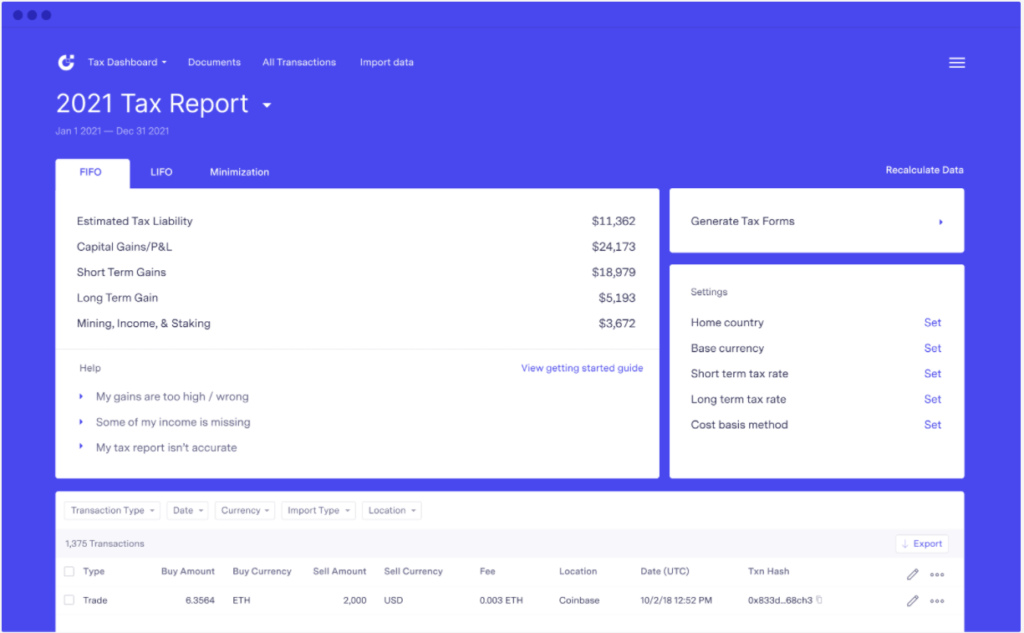

4th Best Crypto Tax Software in the USA: Token Tax

Supports every exchange available and offers integrations. However, it offers no free or trial version.

Also read, TokenTax Review: Crypto tax software and accounting services

Features:

- Automatically integrates to wallets, and exchanges to show all data in one place.

- Calculates taxes on a real-time basis and offers customized reports like Ethereum gas report, tax liability calculation using FIFO, LIFO, minimization, and average cost methods.

- Supports every exchange, unlike other software.

- Advanced reconciliation services for savvy professionals.

Pricing:

- Basic: $65/year for 500 transactions and does not support Defi & NFT transactions.

- Premium: $199/year for 5000 transactions and includes DeFi & NFT transactions.

- Pro: $799/year for 20,000 transactions.

- VIP: $3,499/year for 30,000 transactions.

We can increase the number of transactions in any plan with additional charges. On purchase of VIP subscription add-on service of getting your tax forms filed directly via tax professionals is available at an additional charge of $1000.

5th Best Crypto Tax Software in the USA: Bear Tax

Bear Tax is accounting software that lets you gather all your trades in one place. The software identifies transfers across various exchanges and generates tax documents automatically. It is a budget-friendly tax calculation software.

Features:

- Provides Audit Trail

- Automatically integrates 40+ exchanges and CSV file import feature for other exchanges where API integration is not available.

- Offers smart matching and reconciliation of transactions automatically.

- Fits high-frequency traders as well.

- Download the tax reports from Bear tax and share them with your tax professional to file and pay the tax liability.

- Supports taxpayers liable to pay taxes in the US only.

- Most affordable platform.

Pricing:

- Free plan for tracking and calculating taxes for 20 transactions.

- The basic plan for $49/year for 200 transactions.

- Plus plan for $149/year for 25000 transactions.

- Pro plan for $499/year for 1million transactions.

Conclusion

All the mentioned platforms here provide a similar category of integrations and achieve simplification in calculating taxes. You can decide the one suitable for you based on pricing, especially if you are hodler/long-term investor as there would be no complications in your calculations and can also be done on the DIY plans offered.

Active traders opt for platforms that provide the highest number of auto-sync integrations via APIs across exchanges and wallets, real-time reconciliations, API integrations to automatically sync your data across multiple platforms to avoid the manual hassle. Except for Bear tax other platforms mentioned here have integrated with TurboTax which allows you to directly file your taxes useful for United States taxpayers.

Users with little knowledge about taxes can use the professional services which these platforms provide to complete the tax requirements hassle-free.

Frequently Asked Questions

What is TurboTax, TaxAct & H&R Block Tax Software?

Ans. These are American tax preparation software that helps you file online your federal and state taxes accurately. The crypto tax software helps you compute the taxes payable on your crypto transactions, however, to incorporate them in the requisite format TurboTax, TaxAct, etc. are required to include them with your other income and pay taxes directly online.

Can you pay taxes online using crypto tax software?

Ans. Most of them have integrated with TurboTax, and TaxAct to help you complete the tax filing process there itself. The ones which are not integrated provide downloadable files which can be uploaded on TurboTax to complete the process.

What if the software does not have API integration with your exchange?

Ans. All of them provide a CSV file import option, which allows you to add your transactions to calculate taxes.

Also read: