Trump’s latest tariff hikes on China may shift the global Bitcoin mining industry offshore, as domestic miners face increased premiums on hardware costs.

Bitcoin (BTC) mining may soon shift further offshore as U.S. miners face rising hardware costs. On Wednesday, April 9, a new report from Hashlabs Mining CEO Jaran Mellerud highlighted the economic impact of U.S. tariffs on the domestic crypto mining industry. According to the report, these tariffs could increase mining equipment costs in the U.S. by at least 22% compared to other countries.

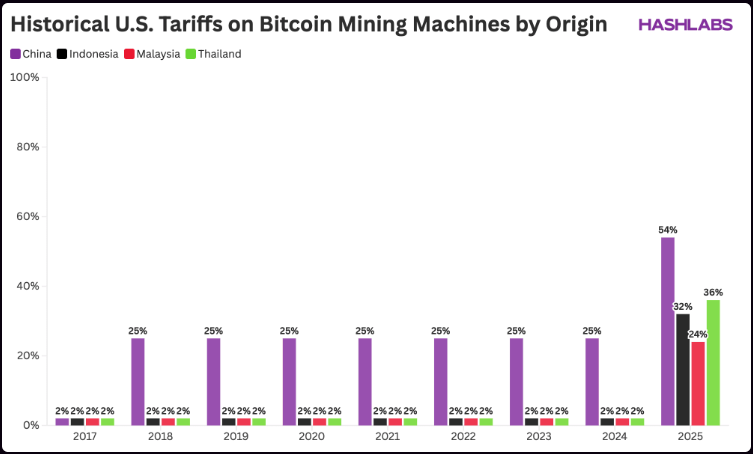

Specifically, U.S. crypto miners rely heavily on imported hardware from Asian countries such as China, Indonesia, Malaysia, and Thailand — all of which are now subject to a minimum 24% tariff on all goods, including mining rigs.

Even in the most favorable scenario — sourcing exclusively from Malaysia, which faces the lowest rate — equipment costs would still rise by 24%. However, this scenario is unrealistic, as U.S. imports come from a mix of suppliers across the region. Notably, the figures cited in the report do not yet account for the recent 50% tariff hike on Chinese goods, which raises the total tariff rate to 104%.

Still, there is a mining equipment stockpile in the U.S., which will drive prices down. As these stocks are depleted, miners will likely have to pay a premium somewhere between 22% and 36% for the equipment, compared to other countries. These figures come from Ethan Vera, the CEO of Luxor crypto mining company, and are echoed in the Hashlabs Mining report.

U.S. Miners scrambled to import rigs ahead of tariffs

This report is in line with earlier fears by industry insiders. Gadi Glikberg, CEO of CodeStream, stated that while tariffs will slow down the growth of the US mining industry. Due to the cost of equipment impacting their return on investments, further expansion plans are unlikely.

“The newly imposed tariffs are unlikely to trigger a mass exodus. However, they may slow down or redirect future expansion plans, as miners reassess the long-term cost-efficiency of scaling operations within the US,” Gadi Glikberg, CEO of CodeStream.

Taras Kulyk, CEO of mining equipment brokerage Synteq Digital, revealed that his firm was working to rush deliveries before the tariff hike took effect.