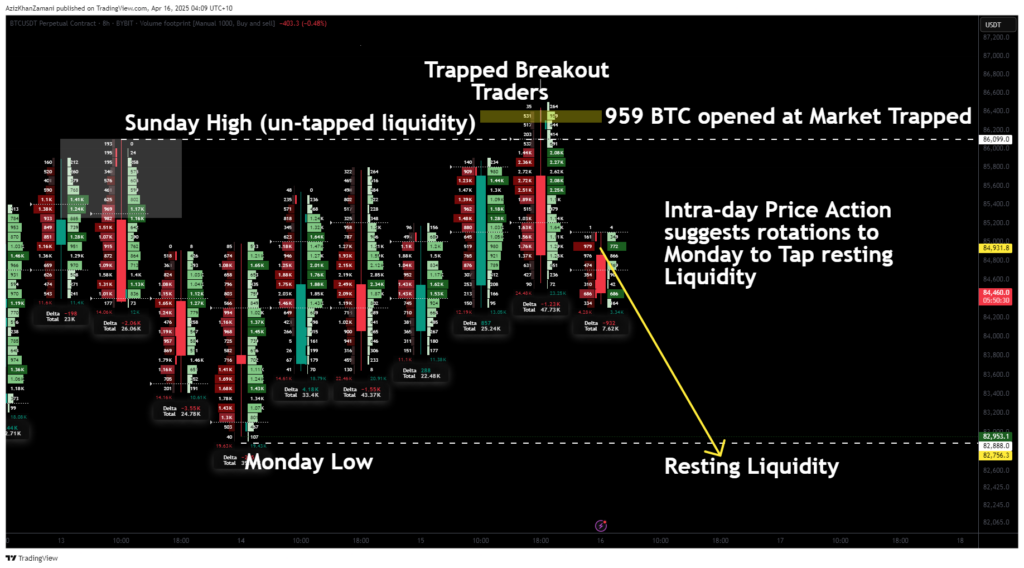

Bitcoin may have printed a local top near $86,500 after a swing failure pattern swept upside liquidity. Order flow data confirms that aggressive long entries were trapped at the highs, with price now targeting resting liquidity lower, particularly around the Monday low at $82,888.

All eyes are now on Bitcoin’s (BTC) Monday low at $82,888, a key liquidity pool that remains untouched. This zone could act as the next target in Bitcoin’s intraday deviation from liquidity pocket to liquidity pocket. These types of moves typically trap breakout traders, creating a momentum shift in the opposite direction.

With order flow confirming significant long exposure now underwater, the path of least resistance has shifted to the downside, targeting the untapped liquidity below.

Key points covered in this article:

- Swing failure pattern trapped long positions at recent highs

- Order flow chart shows 959 BTC in market orders opened at the top

- Price now targeting the Monday low at $82,888 for liquidity sweep

Sunday’s high acted as a magnet for price, with liquidity built up from short traders expecting a reversal. Once price broke above this level, it failed to hold, creating a swing failure pattern—a hallmark setup where price takes out a key high, traps longs, and reverses with force.

This is where the order flow chart provides critical insight. When zooming in, you can clearly see that 959 BTC worth of market orders were opened directly after Bitcoin took out the Sunday high. These positions were entered at the local top and are now immediately underwater, forming the trap dynamic that often fuels aggressive moves in the opposite direction. This creates the classic chain reaction of stop-losses and premature closes, pushing price lower.

With those long positions now trapped, the market is hunting the next pool of liquidity, which lies at the Monday low. The $82,888 level is a logical magnet for price action and aligns with intraday liquidity theory—price will seek out the cleanest levels that haven’t yet been tapped.

If that low is swept, it could produce a bullish swing failure to the downside—mirroring the same pattern we’ve just seen at the highs. This would complete a short-term range rotation and set up the next move higher within the existing structure.

What to expect in the local price action.

It is now important to watch for price to sweep the Monday low at $82,888. If a swing failure pattern forms at that level, it presents a high-probability long entry, targeting the mid-range or highs. Until then, downside remains favored. As always, price action should be used with discretion and proper management.