Pi Network is showing signs of recovery after a turbulent May, but project-specific challenges may delay recovery past $1.

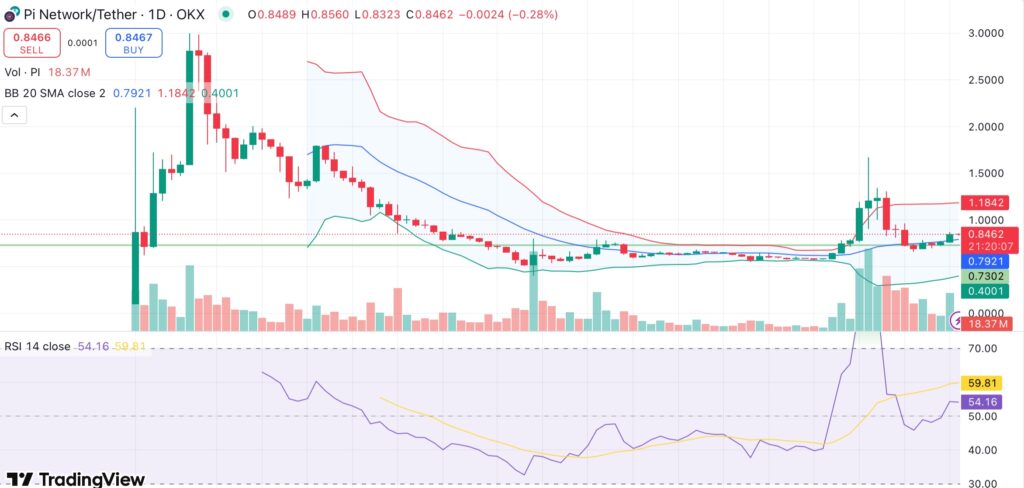

At the time of writing, Pi Coin (PI) trades at $0.84, up 8% in the last day and 30% over the past month. Daily trading volume surged more than 150% to $548 million, indicating renewed market interest following a nearly 50% plunge from May 12 to May 17, when it hit a low of $0.69.

PI still sits 77% below its all-time high of $2.99 set in February. Although the recent price recovery shows that bulls are trying to regain control, the road back to $1 is still challenging, especially given some project-specific obstacles,

The technical outlook is mixed but cautiously optimistic. The relative strength index is in the neutral range at 54, meaning that there is neither an overbought nor an oversold condition. Momentum indicators like the moving average convergence divergence exhibit some weakness, displaying sell signals.

The major moving averages for the 10, 20, 30, and 50-day periods are all trending upward. If conditions hold, these signals, along with a positive Awesome Oscillator and a strengthening trend in the Average Directional Index, suggest a potential upward reversal.

Beyond technical issues, Pi continues to face difficulties. Millions of users are still frustrated by the mainnet migration and know-your-customer verification delays, which limit access and transfers, particularly in China. In addition, the token is not listed on major exchanges like Coinbase or Binance, and liquidity is still low.

Even though the community voted overwhelmingly for a Binance listing, the token is yet to be listed on the platform. Pi’s market depth on platforms such as OKX remains below $100,000, which restricts its growth potential.

Another obstacle is utility. In the absence of significant decentralized finance projects or decentralized apps, the demand for PI is primarily speculative. A rally to $1.35 just before the $100 million Pi Network Ventures fund announcement on May 14 quickly reversed, showing how fragile sentiment can be without real use cases.

Adding to the pressure, more than 1.47 billion PI tokens are scheduled to unlock over the next year, which could increase selling pressure unless balanced by token burns or rising demand. Regulatory uncertainties and concerns about insider selling and centralized control have also raised doubts within the community.

If buyers hold support near $0.74 and push through resistance at $0.90, a move back toward $1 is possible, especially if trading volume stays strong or a major listing or token burn happens. If momentum fades and structural problems remain, PI could fall below $0.74 and tigger another downward trend, with the large upcoming token unlock adding to the pressure.