More than $1 billion in BTC was moved from a long-dormant “Satoshi era” wallet, reactivated just as Bitcoin edges toward a new all-time high.

According to blockchain analytics platform Spot On Chain, the wallet moved 10,000 BTC, valued at approximately $1.09 billion, to a new address after lying untouched for 14.3 years.

On-chain records indicate that the BTC was originally acquired on April 3, 2011, for just $109,246, translating to an average acquisition price of $0.78 per coin. As such, the whale is looking at returns of over 140,000x on the initial investment.

While the exact motivations behind the massive transfer remain unclear, it comes at a time when Bitcoin (BTC) appears poised to reach a new all-time high, with analysts anticipating the milestone could be hit by the end of this week. Currently priced at $109,100, the leading cryptocurrency is just less than 3% away from surpassing its previous high.

Such movements often precede selling activity, as large investors tend to accumulate at lows and realise gains near highs. It’s possible that the whale may be moving funds from a cold wallet to an exchange or a hot wallet.

In the meantime, sentiment among large Bitcoin holders appears to be shifting more broadly. On-chain analytics from Sentora reveal that whales holding over 1,000 BTC have gradually reduced their balances in recent weeks.

While such distribution could exert short-term selling pressure, Sentora analysts argue this trend may represent a positive structural shift.

“Rather than signaling weakness, this redistribution reflects a maturing market,” stated Sentora. “Older ‘whale’ coins are dispersing, a dynamic that should ultimately strengthen Bitcoin’s long-term prospects.”

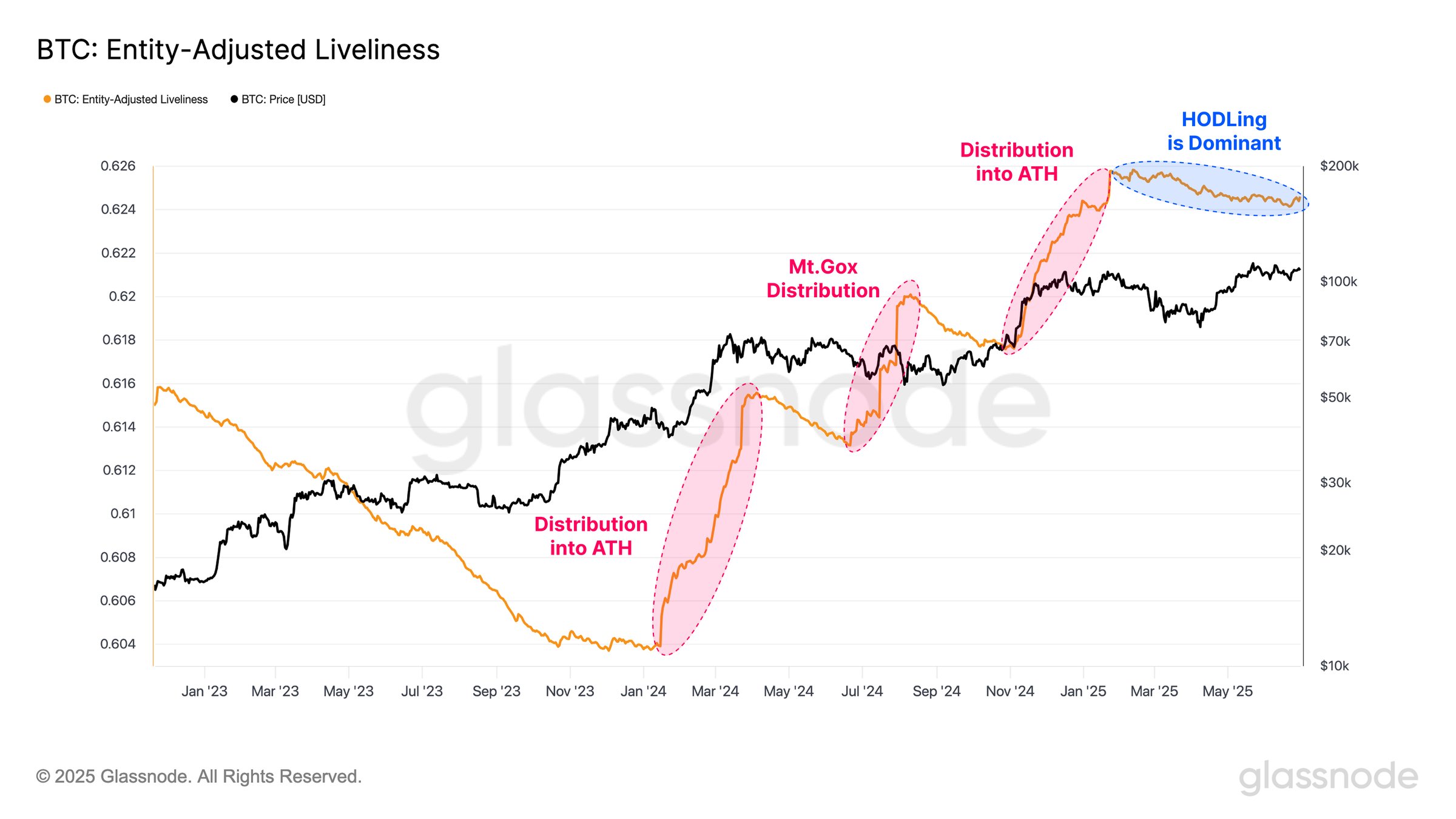

However, data from Glassnode offers a more nuanced counterpoint. The platform’s “Liveliness” metric, which measures the degree to which BTC holders are spending versus holding, has continued to trend downward.

Unlike previous cycles where profit-taking surged as prices reached new highs, current behavior suggests long-term investors are maintaining their positions, even near peak valuations.

Supporting this trend, the total BTC held by long-term holders, defined as those who have held for over 155 days, has reached a record high of 14.7 million coins.

Notably, most BTC that were acquired near the $100,000 breakout threshold remain unmoved, reflecting growing conviction and reduced speculative pressure among investors.

Institutions ramp up their BTC buying

While long-term whale holders could be positioning their holdings for a sell-off, institutional investors have been steadily increasing their exposure to Bitcoin.

Over the past week, multiple companies have announced ambitious plans to establish or expand Bitcoin treasuries. These include Fragbite Group, whose stock surged 64% after revealing its intention to allocate part of its balance sheet to BTC, and Vanadi Coffee, which gained over 240% in a month following shareholder approval to invest up to $1.1 billion in Bitcoin.

Other firms that are jumping in include Belgravia Hartford, which disclosed it had secured $1 million in funding to grow its BTC treasury, while Norway-based Green Minerals announced a plan to raise $1.2 billion for the same purpose.

The uptick in corporate interest shows growing institutional interest in Bitcoin as a strategic reserve asset, especially as it edges closer to price discovery territory. It comes as a growing number of analysts project even higher targets for BTC in the months ahead.

According to crypto trader CryptoFayz, if Bitcoin breaks its current all-time high of $111,960, a continuation to $116,000 is likely, citing technical chart structures.

Meanwhile, long-term projections remain even more bullish. Standard Chartered and Bernstein both forecast Bitcoin to hit $200,000 by the end of 2025, while BitMEX co-founder Arthur Hayes has set an even higher year-end target of $250,000.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.