Bitcoin may be on the cusp of a strong bullish breakout as President Donald Trump considers replacing Jerome Powell as current chair of the Federal Reserve, even though he does not have the authority to do so.

Regardless, if the markets start pricing in lower future interest rates, it typically weakens the dollar and boosts demand for alternative assets like Bitcoin (BTC).

So far, Powell has resisted raising interest rates.

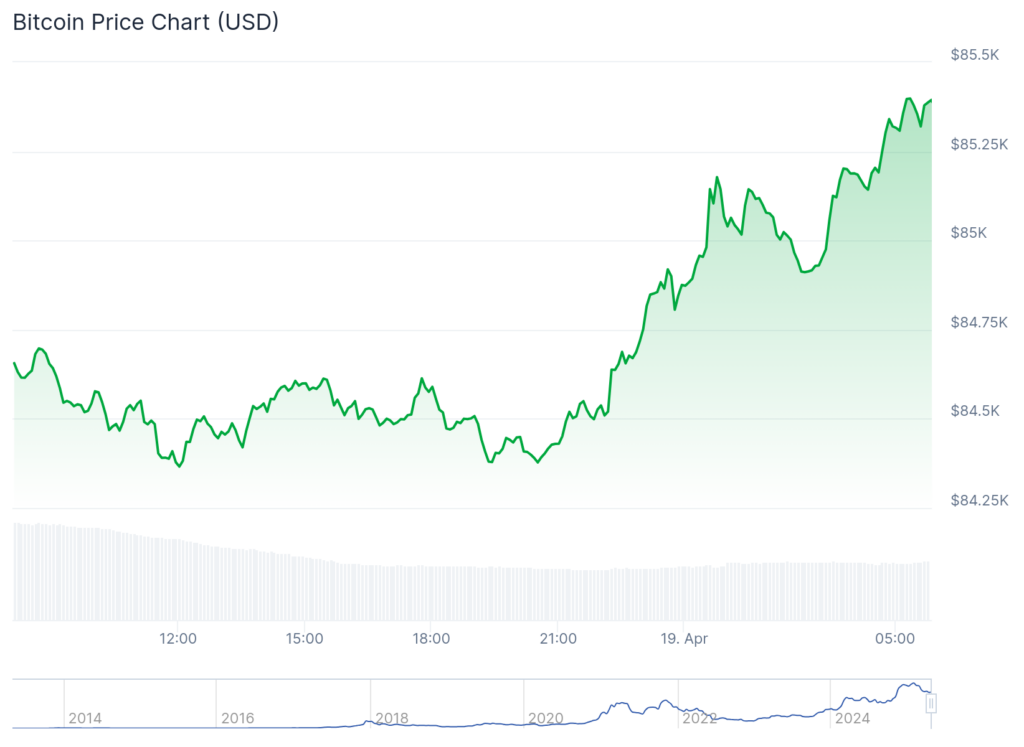

At last check Saturday, Bitcoin was trading at $85,232.30. Its price has remained between the support and resistance points at $84,000 and $85,000, up by about 14% above the lowest point this month. See below.

Under the U.S. Federal Reserve Act, the president can’t fire the chair. The Fed is designed to be independent of political influence so it can make decisions in the best interest of the economy, even if they’re unpopular with the White House.

But Trump’s White House has normalized challenging virtually all political precedents, such as defying court orders on immigration and punishing news organizations that it doesn’t like.

And now, according to Kevin Hassett, the National Economic Council director, Trump is studying whether he has the authority to replace Powell. His statement came after Trump told the press:

“I’m not happy with him. I let him know it. And oh, if I want him out, he’ll be out of there real fast, believe me. If we had a Fed chairman who understood what he was doing, interest rates would be coming down.”

Trump’s statement followed Powell’s insistence that the Fed was not in a hurry to cut interest rates. Instead, the bank is focusing on Trump’s tariffs and whether they will lead to higher inflation. Mary Daly, another Fed official, stated that rate cuts would need to be delayed if inflation persisted at high levels.

Experts believe that Trump can only fire Powell for cause, which is often interpreted to mean misconduct. Should Trump remove him without cause, it could attract major legal challenges.

CNN reported that Trump is considering former Fed governor and crypto startup investor Kevin Warsh to be Fed chair once Powell’s time ends.

What does it mean for Bitcoin?

Cryptocurrency bulls see firing the Fed chair as an erosion of confidence in the central bank. The theory is that such a move would drive the U.S. dollar lower and Bitcoin higher in the long term.

Historically, currencies of central banks that lack independence often underperform. Examples of these are the Turkish lira and the Zimbabwe dollar.

The 4H chart below shows that Bitcoin has been in a tight range in the past few weeks. Notice how it has moved slightly above the 50-period moving average.

Most importantly, the coin has formed a bullish pennant. This widely recognized bullish pattern consists of a vertical line and a symmetrical triangle.

It often leads to a strong bullish breakout when the triangles are nearing their confluence.

Therefore, Bitcoin is expected to have a strong bullish breakout, with the next point to watch being at $88,585, its highest level in April.