Bitcoin didn’t unwrap a breakout this Christmas Eve. Instead, the top cryptocurrency remains locked below the $90,000 resistance level, consolidating in the mid-range as volatility continues to compress.

Summary

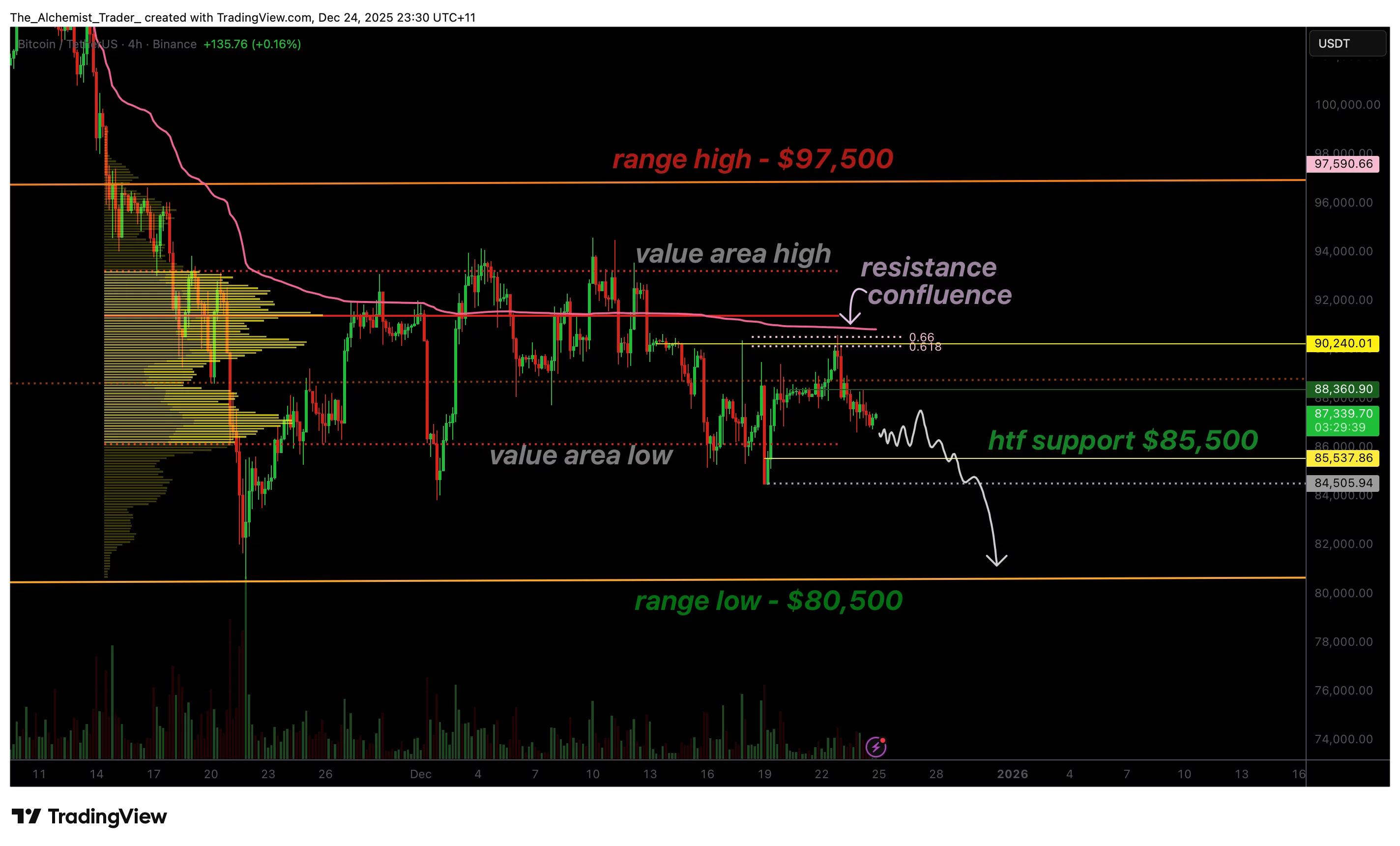

- Bitcoin fails to reclaim $90,000 resistance with multiple confluences.

- Price trades mid-range between $97,500 and $80,500.

- Loss of $85,500 increases downside risk toward $80,500.

Bitcoin (BTC) price continues to trade sideways, as with consolidation dominates price action near the $87,000 region. Despite multiple attempts to regain higher levels, the price has been unable to reclaim a critical resistance zone on a closing basis.

This ongoing rejection has reinforced a broader high-time-frame range, keeping Bitcoin locked in rotational behavior rather than directional movement.

Bitcoin price key technical points

- Major resistance near $90,000 remains unbroken, reinforced by multiple technical confluences.

- Bitcoin trades within a high-time-frame range between $97,500 and $80,500.

- Loss of $85,500 support could open downside toward the $80,500 range low.

Bitcoin’s current consolidation phase is primarily defined by a well-established resistance zone near the Point of Control (POC), which aligns closely with high-time-frame resistance around $90,000 and the 0.618 Fibonacci retracement from the recent corrective leg. This cluster of technical confluence has repeatedly rejected price, preventing any sustained upside continuation.

Each rejection from this region has resulted in price rotating lower, reinforcing the notion that sellers remain active and buyers lack the conviction needed to reclaim control. From a market auction perspective, repeated failures at resistance often lead to balance rather than trend, especially when the price cannot establish acceptance above the value.

Following the latest rejection, Bitcoin rotated back toward support near $85,500, a level that has acted as a short-term floor within the current structure. This rotation is characteristic of range-bound markets, where price oscillates between clearly defined support and resistance levels rather than trending in one direction.

From a broader structural standpoint, Bitcoin is clearly trading within a high-time-frame range bounded by $97,500 on the upside and $80,500 on the downside. Price is currently near the midpoint of this range, an area typically characterized by limited directional bias.

When markets trade near range equilibrium, volatility often compresses as both buyers and sellers wait for confirmation before committing capital.

This mid-range positioning explains the lack of follow-through in recent price moves. Upside attempts stall as price approaches resistance, while downside moves find support before developing into sustained sell-offs. Such conditions are typical during consolidation phases and often precede larger directional moves once balance breaks.

The $85,500 level now serves as a key inflection point. As long as this support holds, Bitcoin is likely to continue rotating within the broader range. However, a decisive loss of $85,500 on a closing basis would shift the short-term bias to the downside, opening the probability of a deeper corrective move toward the $80,500 range low.

From a technical perspective, confirmation remains critical. A bullish resolution would require Bitcoin to reclaim the $90,000 resistance zone, establish acceptance above the Point of Control, and hold that region on a closing basis. Without these signals, upside moves risk being rejected as part of ongoing consolidation, a scenario consistent with expectations that Bitcoin may trade sideways into 2026 as ETF inflows normalize.

Conversely, a bearish resolution would involve a clean break below $85,500, followed by acceptance at lower prices. Such a move would likely accelerate toward the lower boundary of the range as liquidity is taken out below interim supports.

Bitcoin price action: What to expect

Bitcoin is likely to remain range-bound between $97,500 and $80,500 as long as resistance near $90,000 caps price and $85,500 holds as support. A decisive break above or below this range will determine the next major directional move.