Digital asset investment products saw the highest inflows this year with $3.34 billion with Bitcoin investment products leading the charge, according to a new report by CoinShares.

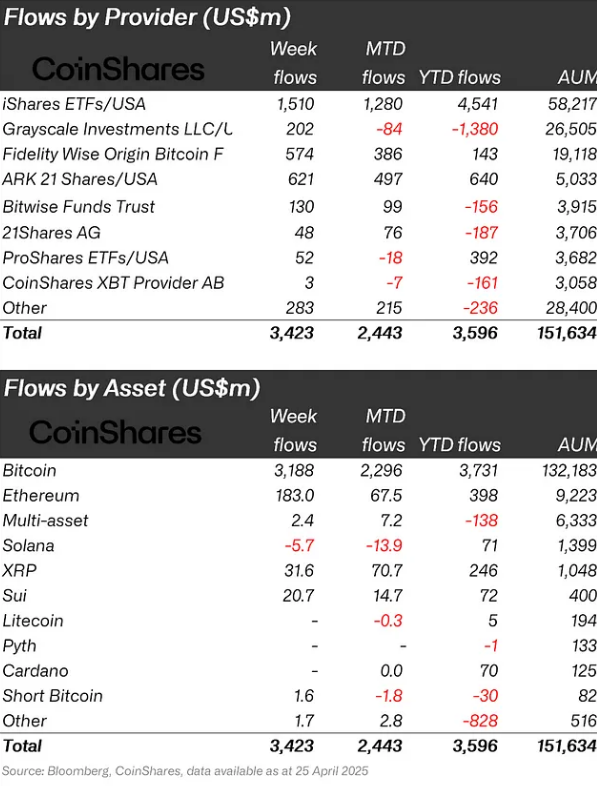

Last week, the digital asset market recorded its highest amount of inflows since mid-December 2024 and the third-largest weekly inflow of all-time. Digital asset investment products saw $3.4 billion in inflows coming in from all providers. BlackRock’s iShares ETFs contributed the largest share by product, with weekly inflows amounting to $1.5 billion.

Other digital asset investment products that saw large inflows include ARK;s 21Shares with $621 million and Fidelity Wise Origin with $574 million.

CoinShares head of research James Butterfill believes the influx of capital into digital asset investment products may be due to investors flocking to safe haven assets as a hedge against the economic uncertainty posed by more conventional assets.

“We believe concerns over the tariff impact on corporate earnings and the dramatic weakening of the U.S. dollar are the reasons investors have turned towards digital assets,” wrote Butterfill.

When measured by asset type, Bitcoin (BTC) investment products remain the largest contributor to inflows, bringing in $3.18 billion in inflows last week. In fact, the amount of total assets under management for Bitcoin have now reached $132 billion, a level the market has not seen since February this year.

Ethereum (ETH) investment products also saw $183 million inflows last week, effectively breaking the asset’s previous 8-week streak of outflows. On the other hand, Solana (SOL) became the only altcoin with outflows last week, reaching $5.7 million. Other altcoins saw little to no activity, with the exception of SUI (SUI) and XRP (XRP) which saw inflows amounting to $20.7 million and $31.6 million respectively.

CoinShares’ latest report also noted that U.S. investors have been adding to their positions, contributing the largest share of inflows by region. Last week, U.S. saw inflows reaching $3.3 billion. Not only that, Germany and Switzerland also saw inflows of $51.5 million and $41.4 million respectively.

This reflects the positive market sentiment present in the broader global landscape, with only Brazil and Canada experiencing outflows.