Hedera Hashgraph price continued its downward trend on Monday, May 19, as demand for Bitcoin and other altcoins eased.

Hedera Hashgraph (HBAR) dropped to $0.1870, down by almost 20% from its highest level this month and 54% from its highest in November last year.

The ongoing HBAR price retreat happened as the crypto market lost momentum. Bitcoin (BTC) retreated to $102,000, a day after it hit $107,000 for the first time since January.

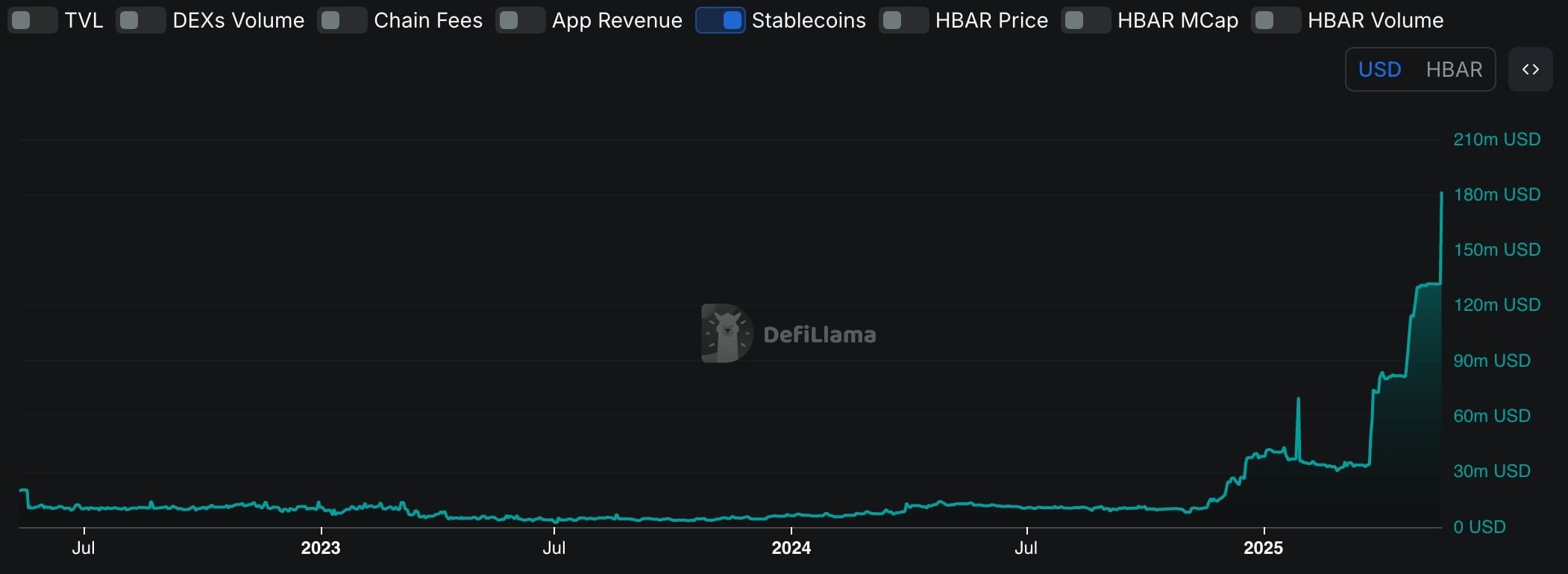

Third-party data shows that Hedera’s network fundamentals remain strong, with the total value locked in its decentralized finance ecosystem rising by 15% over the last 30 days to $186 million. The top-performing platforms are Stader and Bonzo Finance.

Additional data shows that the supply of stablecoins on Hedera has surged significantly. As shown in the chart below, the supply jumped to $181.2 million on Monday, up from a year-to-date low of $40 million. It stood at $131 million just last Friday.

A soaring stablecoin supply on a blockchain is generally seen as a positive indicator, suggesting rising on-chain activity. It can also drive higher network revenues as transaction volumes increase. For example, Tron (TRX) has become the most profitable chain due to its dominant share of Tether transactions.

Decentralized exchange volume on Hedera also climbed, with a more than 80% increase in the past week to $70.4 million. This brought the network’s cumulative DEX volume to $4.58 billion.

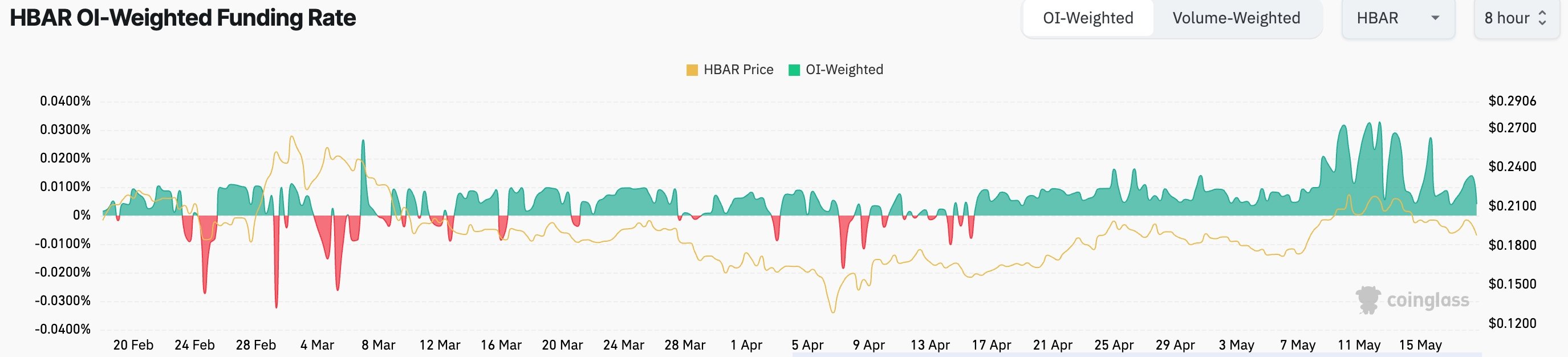

Another bullish signal is that the funding rate in the futures market has remained positive since April 16. A positive funding rate indicates that traders expect future prices to rise, a generally bullish sentiment.

HBAR price technical analysis

The daily chart shows that HBAR has pulled back in recent sessions. On the positive side, the token remains above the 200-day Exponential Moving Average and the 61.8% Fibonacci retracement level.

Hedera has also formed an inverse head and shoulders pattern, a popular bullish reversal sign in technical analysis.

Therefore, the Hedera price may bounce back in the next few days as the US credit rating downgrade jitters end. If this happens, the initial target to watch will be at $0.2240, the 50% Fibonacci Retracement level. A move below the support at $0.15 will invalidate the bullish outlook.