Ethereum price crashed by over 6% on Friday, continuing a downtrend that started on March 24 when it peaked at $2,105.

Ethereum (ETH) dropped to a low of $1,880, its lowest level since March 18. It has now erased most of the gains made in the past two weeks.

Ether crashed after the US released hot inflation data, pointing to higher interest rates for longer. The core Personal Consumption Expenditure Index rose from 2.7% in January to 2.8% in February. The headline PCE rose to 2.5%, higher than the Federal Reserve target of 2.0%.

These numbers mean that inflation will remain stickier for a while, especially after Donald Trump implements his Liberation Day tariffs. Higher inflation means the Federal Reserve may hold higher interest rates for longer.

This explains why other risky assets dropped after the PCE report. The S&P 500 index dropped by 1.50%, while the Nasdaq 100 and Dow Jones crashed by 2% and 1.2%, respectively. Most cryptocurrencies, including Bitcoin (BTC) and Cardano (ADA) also crashed.

Ethereum price also crashed as the fear and greed index dropped to 25 ahead of Trump’s tariffs. Economists caution that these tariffs may lead to a recession, erasing some of the growth that happened under Joe Biden.

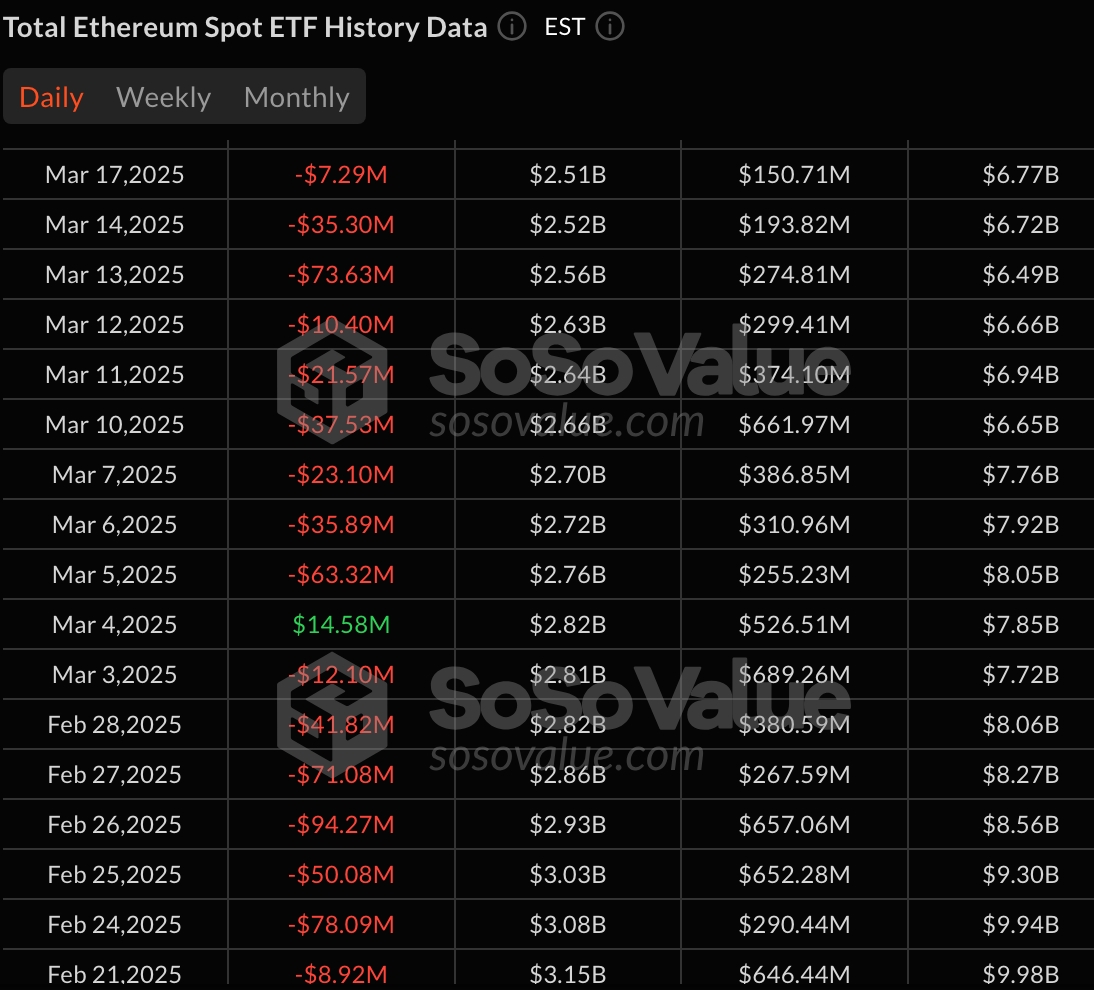

Further, Wall Street investors stay on the sidelines as Ethereum challenges remain. SoSoValue data show that spot Ethereum ETFs had inflows just once in March. They added $14.8 million in net assets on March 4, and have shed assets since then, bringing the cumulative assets to just $2.4 billion. All Ethereum ETFs have just $6.86 billion in assets.

Further, Ethereum has continued to lose market share in key industries like decentralized finance, non-fungible tokens, and decentralized exchanges. It has lost share to layer-1 chains like Sonic and Berachain, and layer-2 networks like Base and Arbitrum.

Ethereum price technical analysis

ETH price has also crashed for technical reasons. The weekly chart shows that it formed a triple-top pattern at $4,000 and a neckline at $2,130, its lowest level in August last year.

Ethereum dropped below this neckline earlier this month, and then retested it this month. A break-and-retest pattern is a popular continuation sign. It has also formed a bearish flag pattern, comprising a vertical line and some consolidation.

Therefore, there is a risk that the coin will crash to $1,537, its lowest point on October 9. A move above the resistance level at $2,131 will invalidate the bearish view.