The price of Uniswap has crashed into a bear market after falling by over 20% from its peak in May of this year.

Uniswap (UNI) was trading at $6.95 on Saturday, July 5, which is significantly lower than its last November high of $20. This decline has brought its market capitalization to $4.8 billion, down from last year’s high of over $10 billion.

UNI’s price crash has coincided with the ongoing sell-off of altcoins. The market cap of all cryptocurrencies, excluding Bitcoin (BTC), Ethereum (ETH), and stablecoins, has dropped by nearly 30% this year.

One possible reason why Uniswap price has crashed is that it has lost market share in the decentralized exchange industry. For example, its DEX volume in the last 30 days was $80 billion, much lower than PancakeSwap’s $160 billion.

The DEX industry has also faced increased competition from Hyperliquid, which handled over $220 billion in volume during the same period. Other top protocols competing with Uniswap are Raydium and Aerodrome Finance.

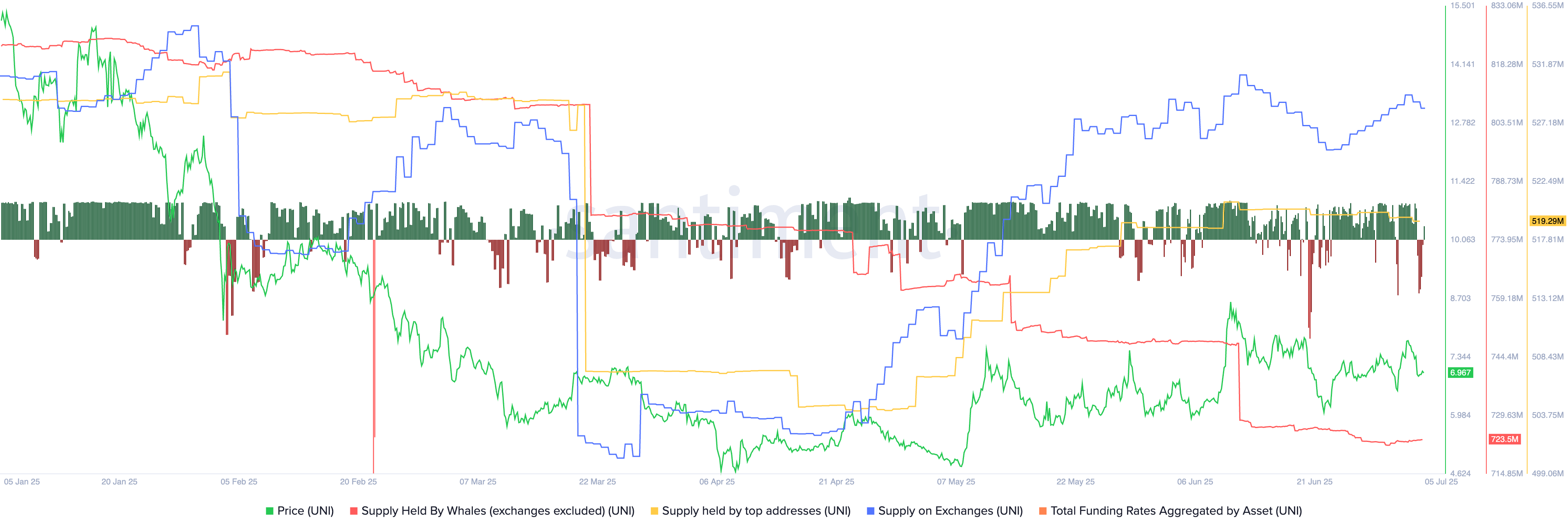

On-chain data also indicate that investors have continued dumping the UNI token. The supply of UNI on exchanges has jumped to 84.6 million, up from the year-to-date low of 69 million. Rising exchange balances is a sign that holders are selling their coins.

UNI price has also dropped as the supply held by whales has dwindled. These investors hold 723 million coins, down from 824 million in January. Whale dumping signals that they expect the coin to continue falling.

UNI’s funding rate has also moved into negative territory, implying that investors anticipate the future price to be lower than it is today.

Uniswap price technical analysis

The daily chart shows that the UNI price has crashed from a high of nearly $20 in November last year to $6.98. It has pulled back after plunging from the year-to-date low of $4.7 to the current $6.9.

The Uniswap price has also formed a bearish flag pattern, which consists of a vertical line and an ascending channel. Therefore, the coin is likely to experience a bearish breakdown, with the next key point to watch being the year-to-date low of $4.70. A move above the important resistance level at $8.6, the highest swing in May, will invalidate the bullish view.