In April, many crypto market observers were writing about an ongoing decoupling or divergence of Bitcoin from equities, meaning that the trajectory of Bitcoin’s price took a different direction compared to stocks and equities. Bitcoin and Gold are up, while the American dollar and stocks are down. However, opinions among market experts on whether the Bitcoin and equities markets have truly diverged vary.

Some enthusiastically proclaim that Bitcoin has decoupled from risk assets and joined Gold as a safe haven. The reason is not hard to see: lately, Bitcoin and Gold have been the only major assets with positive price movements. On April 21, 2025, the price of Gold crossed the $3,400 mark for the first time. This unprecedented rally is widely seen as a response to growing uncertainty among investors, stocks and altcoins went through a wave of liquidations and some of the strongest declines in years, prompting a shift toward Gold.

For most of the 2020s, the gold price fluctuated between $1,800 and $2,000, only starting to climb in the fall of 2023. MacroTrends points to a correlation between the price of gold and global economic uncertainty. Another correlation is the alignment of gold prices with the level of U.S. national debt.

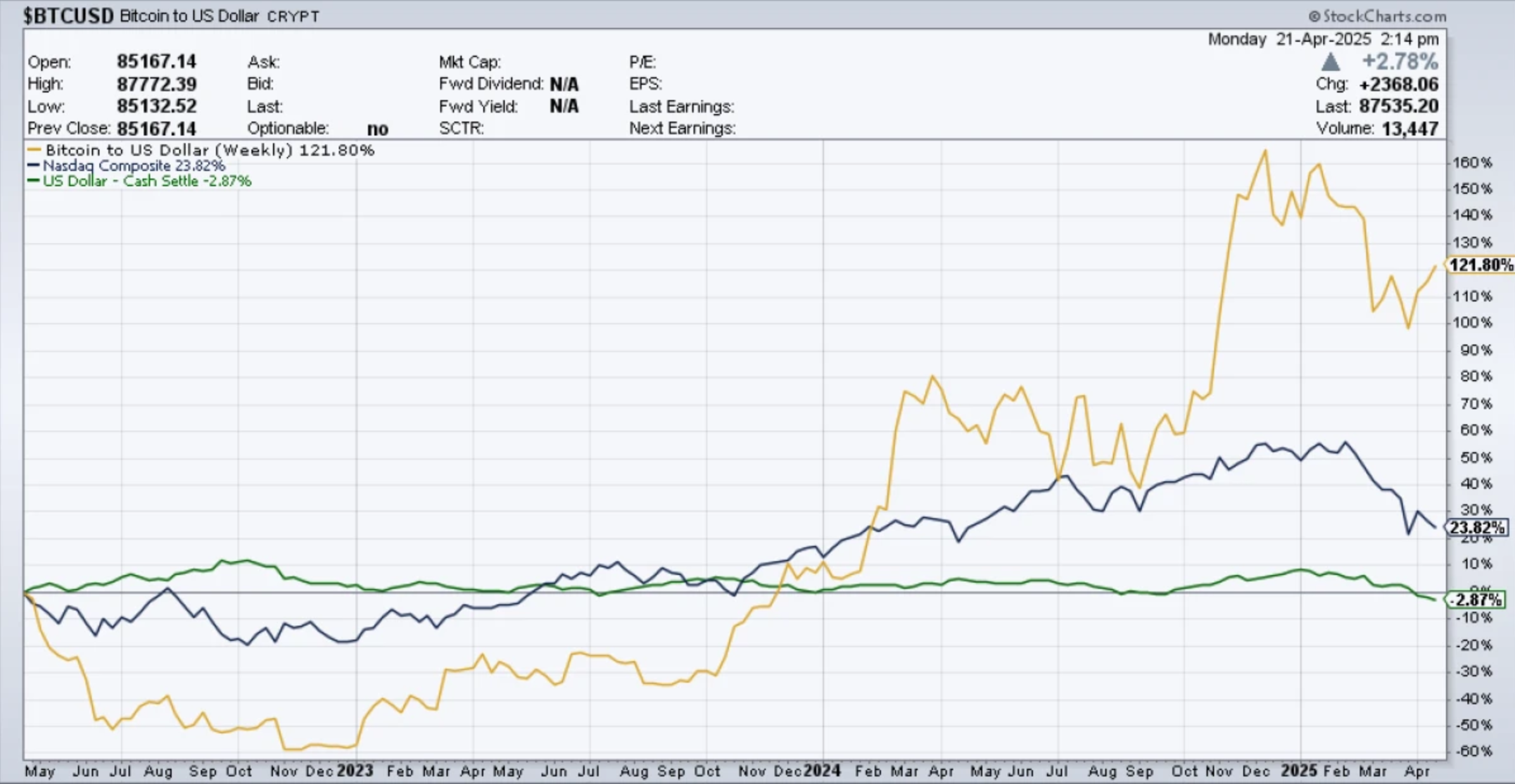

Gold is traditionally seen as a safe haven. Bitcoin has a similar reputation among many investors. However, an influx of institutional investors buying Bitcoin led to a relative alignment of BTC’s price with stocks. Some viewed Bitcoin as an extension of the stock market, but with higher price amplitude. The chart below clearly shows that over the past three years, Bitcoin has mirrored Nasdaq movements closely, mimicking its ups and downs with sharper swings.

Experts remain divided on this. For instance, in March 2025, BlackRock’s Robbie Mitchnick stated that Bitcoin is still yet to consistently move in line with Wall Street, although he anticipates it will happen as more TradFi investors start trading Bitcoin.

Did Bitcoin really decouple from stocks?

The second half of April saw Bitcoin and Gold rise, while major assets including stocks and the USD dropped. On April 22 alone, Bitcoin gained 7%, while risk assets ended the day in negative territory.

Many in the crypto community quickly reacted, declaring that Bitcoin was undergoing a decoupling from stocks. Bitcoin and Gold seemed to confirm their roles as safe havens, while other assets appeared increasingly risky and vulnerable amid political and economic turmoil.

However, the debate over whether Bitcoin is truly decoupling continues. While there is no doubt that Bitcoin currently stands apart from stocks and the dollar, some market observers warn this could be a short-term phase. They suggest that as headwinds take hold, Bitcoin may eventually follow the broader stock market’s downtrend. In other words, the current divergence could turn out to be just a temporary fluctuation.

Some commenters attributed the Bitcoin rally to increased liquidity, encouraging investors to “ignore the noise.” They argue that Bitcoin can surge thanks to technical triggers even when news sentiment is mixed. Others pointed to macro headlines as a major driver of the demand for Bitcoin, including comments from U.S. Treasury Secretary Scott Bessent suggesting a possible de-escalation between the U.S. and China. Meanwhile, headlines reported that India was considering sanctions against China, and China itself urged countries to reject collaboration with the U.S.

In this light, it appears that Bitcoin’s rally was at least partly news-driven. Such major economic shake-ups don’t happen often, suggesting that the current decoupling may be more extraordinary than permanent. Bitcoin could realign with the stock market once the trade tensions subside.

Why is decoupling important?

We asked our market analyst and trader, Ekta Mourya, to enlighten our readers on this topic. Here’s what she replied to why decoupling is important and whether she sees the current decoupling as a temporary or a long-term phase:

“Bitcoin’s decoupling comes at a time when the largest cryptocurrency’s correlation with Gold rises. BTC’s outperformance against the Nasdaq during Trump’s tariff crisis marked a pivotal shift in Bitcoin’s price this cycle, bringing back the “digital Gold” narrative.

Bitcoin’s 30-day Pearson correlation coefficient with Gold is up from -0.7 in March 2025 to 0.45 and rising as of April 2025. For traders, this signals an opportunity to enter long positions; it opens doors for Bitcoin’s re-test of the $109K all-time high and likely price discovery.

Bitcoin’s divergence from the stock market feels more like a temporary blip rather than a permanent shift. Market volatility, tariff tensions, and weak earnings are rattling U.S. equities, while Bitcoin is catching a bid as a safe haven for traders’ capital. However, structurally, BTC has always stood apart; it is a high-beta asset with a growing appeal for portfolio diversification. Both retail and institutional traders should watch Bitcoin for its evolving risk/reward profile and gains.”