James Wynn has now fully lost the gains he recently made in a series of high-risk trades. With his current bet nearing the liquidation threshold, Wynn now stands on the brink of losing the principal tied to that position as well.

According to reporting by EmberCN, Wynn made $11.67 million by going long on Trump (TRUMP) and Fartcoin (FARTCOIN) between May 12–13. However, on May 23, he lost $5.29 million through long positions in Ethereum (ETH) and Sui (SUI).

A brief rebound followed on May 24, when longs on Bitcoin (BTC) and Pepe (PEPE) netted him a $42.08 million profit. But the gains were again eroded between May 25–27, as shorting BTC and longing PEPE led to a $16.72 million loss.

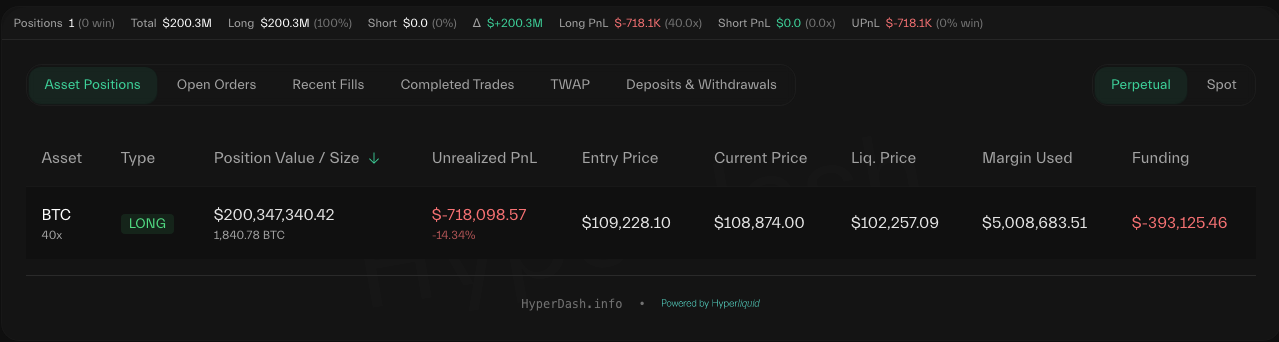

At press time, Wynn’s open BTC long position has already incurred an unrealized PnL of $718,098. He is currently long 1,840 BTC with 40x leverage—valued at $200,347,340. The position was opened at $109,228, and his liquidation price stands at $102,257, putting his principal at risk if the market moves further against him. The current BTC price is $108,874, only 6% away from liquidation.

James Wynn, however, appeared unabashed and determined to recoup his losses. In a defiant tweet aimed at those reveling in his portfolio drawdown, he wrote:

“For all my haters out there who so very much loved to see my portfolio swing down by $60,000,000… just know, now you get to see it swing BACK UP INTO THE HUNDREDS OF MILLIONS. Money that haters like you can’t even dream of having because it’s so far out of your capabilities. Enjoy the show.”

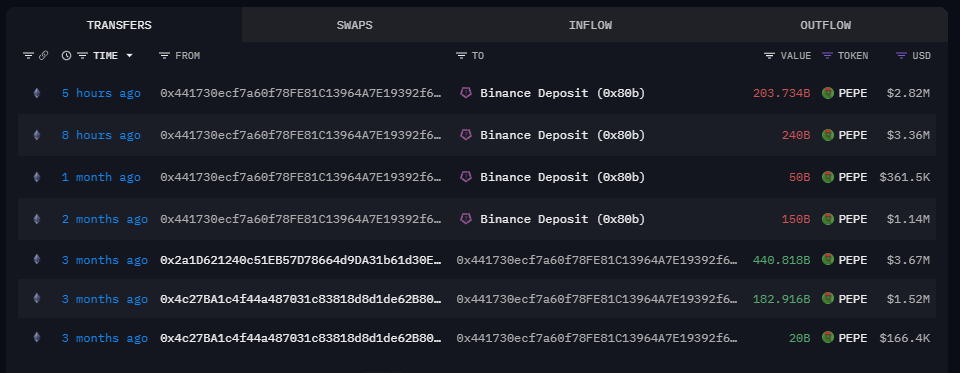

Wynn may have already begun efforts to recoup his losses. According to monitoring by The Data Nerd, a whale address believed to be associated with Wynn recently deposited 44.337 billion PEPE (worth approximately $6.17 million) to Binance. These tokens were accumulated at an extremely low entry price, yielding a return of 11,117X.