One of the differences between the cryptocurrency bull market today and in 2017-2018 is the dominance of trading bots. Previously, bots were exotic, and only traders with coding skills could use them. There are so many crypto trading bots that finding the best one for your skills and goals isn’t that easy.

This post will compare three popular crypto bots: Stoic vs 3Commas vs Pionex. We’ll first review each crypto bot separately, including its profitability and pricing. After that, we’ll make the final verdict.

| Features | 3Commas | Pionex | Stoic |

|---|---|---|---|

| Plans | Free to $99 a month, 50% discounts available if paid annually | 10% of profits for the Arbitrage bot. Other bots are free (although need to pay trade commissions) | 5% of the balance, minimum $50 for a $1k balance. Up to 50% discounts available for referrals |

| Feature | Bot setup might be complicated for new users | No need to set up API keys but must transfer funds to Pionex | No settings are required. Just connect to Binance via API keys |

| UI/ App | Web app with all features as well as mobile apps with some features | A user-friendly web app | Straightforward apps for iOS, Android, and the web — only used to quickly connect to the exchange. |

| Support | Responsive customer support | Support by email or in the Telegram chat | Speedy support via in-app chat, email, and Telegram |

| MarketPlace | A lot of bots presets and ready to use tools | No | No, but a strategy works right out of the box |

Stoic

What is Stoic?

Launched in 2020, Stoic is a crypto trading bot with AI. It was created by the Cindicator team, which has been active in the crypto market since 2017 and has previously shipped several analytical products for crypto traders.

Stoic’s algorithm leverages Cindicator’s data and uses hedge-fund grade quant research.

As the first step, Cindicator regularly collects forecasts from 180,000 analysts registered on its platform. It then applies various AI models to improve the accuracy of these forecasts.

The next step, quant research, is different: it analyses each crypto asset’s volatility, correlation, and previous returns to algorithmically build and rebalance a portfolio. The rebalancing is usually done once a day.

Also read, SmithBot AI Crypto Trading Bots- Live Trading Test

Stoic’s current strategy is long-only, which means there is no short selling. This is intentional because shorting has a theoretically unlimited risk of loss. And this risk isn’t so theoretical in a long-term bull market where prices could shoot up by double-digits in a matter of days or even hours.

[optin-monster-inline slug=”kypqbd8bxbsurarmqsxd”]

Stoic uses a built-in ‘hedge’ to soften temporary blows from inevitable market sell-offs. The algorithm keeps some funds in USDT. This ensures that there is enough money to buy the dip when prices are fall. The share of USDT is determined algorithmically, but users also can set their own hedge. For example, some might set it to zero if they think the bottom is in. Others might temporarily set to 100% when they think the market is at its peak and the crash is coming at any moment.

While all of this might sound complicated, for Stoic users, everything is straightforward. Users can connect this crypto bot to their Binance accounts in just a few clicks. Create an API key, scan it with the Stoic app, and the strategy will start running.

Read our Stoic Review to know more.

Is Stoic profitable?

Since it was launched on 18 September 2020 until 17 August 2021, Stoic has delivered a return of +1,334%. Stoic’s algorithm outperformed both BTC and a simple altcoins portfolio with equal weights: those assets returned 498% and 308%, respectively.

This transparent track record nicely illustrates Stoic’s difference from other crypto bots. Most bots automate the trades, yet the user needs to set up a strategy. Stoic does everything for the user.

Who is Stoic best for?

Stoic is a crypto bot suitable for both crypto newbies and experienced traders alike. For people new to crypto, Stoic solves most of the problems. It provides a viable trading strategy, exposing a wide range of crypto assets. And the user doesn’t need to do any research or watch the charts.

Experienced traders can use Stoic as a total bet on the altcoin market. Most traders focus on BTC, ETH, and perhaps a few of the greatest assets they track and know well. Instead, Stoic’s algorithm considers all crypto assets with at least $10 million in daily volumes on Binance. No human trader would be able to do that without some automation. Stoic does this right away without any additional settings.

Stoic pricing

Unlike most crypto bots, Stoic charges an annual fee based on the crypto account balance. Currently, the fee is 5%, but it could be reduced through a referral program. Stoic requires a minimum account balance of $1,000, so the lowest fee would be just $50 for a full year of Stoic.

3Commas

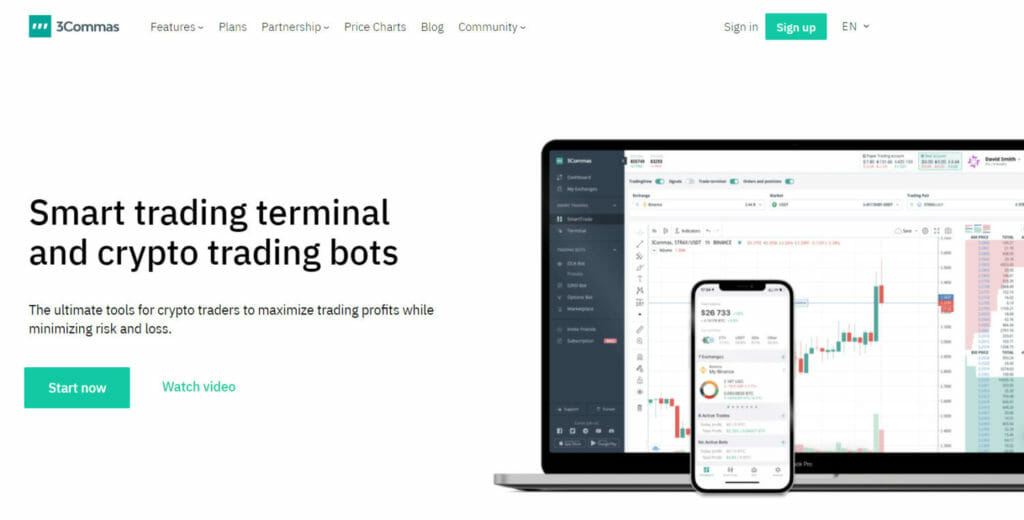

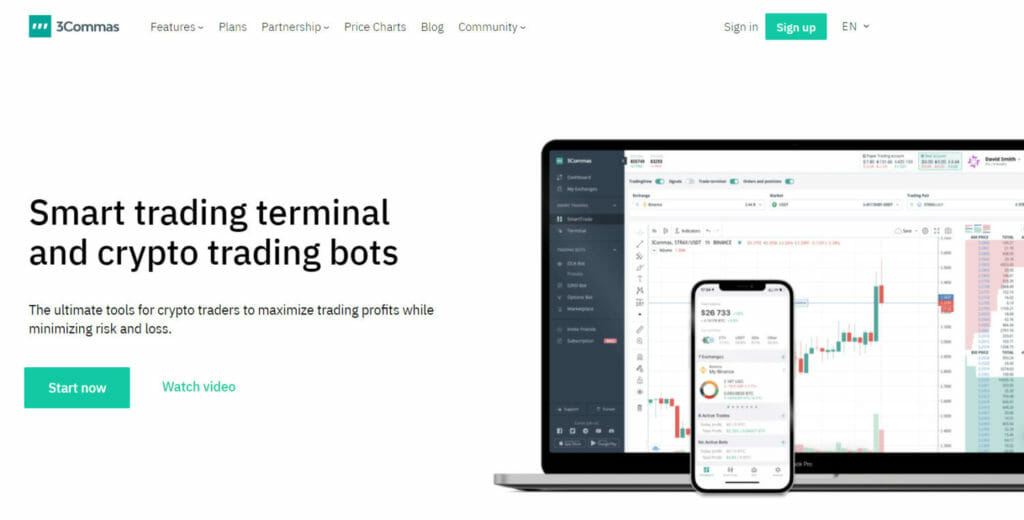

What is 3Commas?

Launched in 2017, 3Commas emerged as a trading terminal supporting crypto bots on 23 exchanges. It has a suite of tools for new and experienced traders alike.

3Commas offers both ready-to-use crypto bot presets and tools for automating trades, including advanced take-profit and stop-loss orders. 3Commas connects to exchange accounts via API keys like Stoic and other bots.

There are two main types of bots for new traders: DCA bots and GRID bots.

DCA or dollar-cost averaging bots automatically buy a certain amount of cryptocurrencies for a fixed sum in USD or other currency at regular intervals (e.g., every week). This helps optimize the cost because crypto might be more expensive, and it would be cheaper at other times. This removes the risk of investing a lump sum at a peak price.

GRID bots automatically buy at a predetermined low price and sell higher. The trick, of course, is to know the price range. The bot creates a grid of buy and sells orders — that’s where its name comes from.

Read our 3Commas Review to know more.

Is 3Commas profitable?

With 3Commas, each user sets up their own trading strategy. So it’s hard to determine profitability. Of course, skilled traders have an advantage because they know how to best select a price range for grid bots.

Meanwhile, the profitability of DCA bots depends mainly on the market. Over a long time, a DCA bot would lower the impact of volatility and give a better average entry price.

For example, from early 2018 until late 2020, a DCA bot buying BTC would have entered at high and low prices. It would be much better than just buying BTC around the all-time high in January 2018.

On the other hand, right before a significant bull run, it’s best to just invest a lump sum while the price is still low.

Also, read 3Commas vs HaasOnline | Which is the best trading bot?

Who is 3Commas best for?

It appears that 3Commas is best for experienced traders and investors who want to automate some tasks. For example, 3Commas would work well for those who want to enter prominent positions with DCA bots or gradually increase their deposits with Grid bots.

New traders, however, might get confused by the multitude of options available. And jumping from one strategy to another is nearly guaranteed to result in poor performance.

Also read, 5 Best Crypto Grid Trading Bots | Grid Bot [2021]

3Commas pricing

Pricing plans range from free for a single bot and go up to $99 per month for an unlimited number of bots.

Pionex

What is Pionex?

Launched in 2019, Pionex is a cryptocurrency exchange with several ‘free’ built-in bots. The exchange is regulated in Singapore and the US.

On Coinmarketcap, Pionex ranks #75 with a 4.5/10 score, which evaluates average liquidity, web traffic, confidence in truthful reporting, and other factors. The exchange does about $1.5 billion in daily volumes or about half the volumes on Coinbase and about 17 times less than volumes on Binance.

Also, read Pionex vs Binance 2022 | Trading, Fee, and Bots

Like 3Commas, Pionex offers Grid bots, aiming to buy when the price is low and sell when the price is high. As discussed, it’s easier said than done. If the price falls far below your range, the bot would not be able to ‘sell high.’ Similarly, if the price breaks out above your range and continues to go up, you’ll be left without a position and will miss most of the upside.

Another interesting crypto trading bot offered on Pionex is the so-called spot-future arbitrage bot. In short, this bot works by simultaneously selling short a perpetual futures contract and holding a similar long position in the spot market. This strategy arbitrages the preferences for long positions in the futures market and earns the funding rate, which could add up to 10% to 20% APY.

Although this is considered a low-risk strategy, there are still risks involved, for example, the risk of margin calls on a short position if the price would surge.

There are also several other types of crypto bots, and Pionex keeps innovation to introduce new algorithms and tools.

Read our Pionex Review to know more.

Who is Pionex best for?

It seems Pionex would be most attractive to new traders with less experience.

Novice traders might benefit from its relatively simple interface and the absence of meddling with API keys. In fact, everything might be even too simple, encouraging users to create too many bots. That would be in Pionex’s interest because the exchange earns money on each trade.

Also read, Pionex Arbitrage Bot | Earn through Spot – Futures Crypto Arbitrage

Pionex pricing

While there is no monthly fee for running bots on Pionex, the exchange still charges fees for trades. These could really add up regardless of whether your bot is profitable or not.

Stoic vs 3Commas vs Pionex: Conclusion

To sum, Stoic, a crypto trading bot with AI, is currently the best option for both new and experienced traders alike.

3Commas could be great for experienced traders who understand the crypto market and know exactly what to automate. And Pionex would suit complete beginners who want to try using bots for free (although, of course, nothing is ever free).

Meanwhile, Stoic offers a single portfolio strategy based on hedge-fund-grade quantitative research. The strategy already has more than a year-long track record, which for the crypto sphere is a considerable time. Since its public launch in September 2020, Stoic has made +1,334% as of August 2021.

Meanwhile, Stoic is very affordable: just 5% a year. The minimal balance of $1,000 also allows anyone to try it before committing higher sums.

And the best part is that, unlike most other bots, Stoic requires no set-up. Simply connect to Binance via an API key and let it run.

Also read,