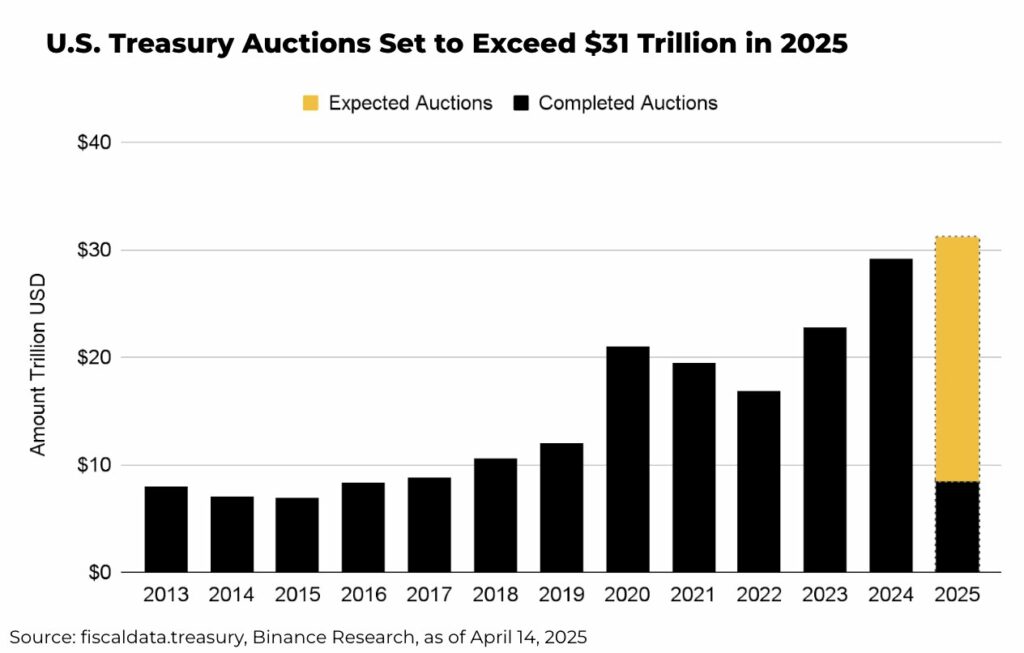

Binance says the United States Treasury supply will hit a record $31 trillion in 2025, a scenario that could have an impact on the macro environment and cryptocurrencies.

According to a Binance Research report on April 18, U.S. Treasury issuance is expected to rise to a staggering $31 trillion in 2025. This spike in Treasury bonds will see supply account for about 109% of gross domestic product and 144% of the M2 money supply.

With this indicative of looming financing pressure—including from auction refinancing—investors may want to pay close attention to what happens. Ideally, changes in M2 tend to have significant implications for stocks, bonds, and other market segments such as crypto.

Binance Research analysts note that foreign demand will be a key variable in this scenario of massive debt issuance.

Of the expected supply, about a third will be owned by foreign holders.

If appetite for U.S. debt falls, or there’s “outright selling, driven by geopolitics or portfolio rebalancing”, a ballooning of financing costs will follow. Yields, elevated, will go higher.

“Even if demand holds steady, the sheer scale of issuance is a structural challenge. Recent risk asset relief—possibly tied to optimism around trade talks—does little to offset the ongoing pressure that this massive supply pipeline places on interest rate markets throughout 2025,” Binance Research noted.

Stocks and crypto, including Bitcoin (BTC), have suffered notable downside pressure in recent weeks. Tariffs have added to jitters, with the Federal Reserve not coming to the party with a rate cut. President Donald Trump has even threatened to fire Fed chair Jerome Powell.

Analysts say persistent upward pressure amid a surge in Treasury supply has the potential to impact risk assets. Nonetheless, a scenario where the government turns to debt monetization, with the money printer going “brrrr”, would be bullish for risk assets.

In this case, investors seeking to hedge against currency debasement will flock to Bitcoin and other “hard assets.”