BVNK has secured backing from Visa Ventures, marking the payments giant’s latest move to integrate stablecoin technology into its global network.

Stablecoin payments infrastructure provider BVNK has secured a strategic investment from Visa, deepening the traditional payments giant’s push into blockchain-based settlement technologies. The investment, made through Visa Ventures, was announced Tuesday by BVNK CEO Jesse Hemson-Struthers.

Although the financial terms weren’t disclosed, the move follows BVNK’s $50 million Series B round in December 2024, which was led by Haun Ventures and included backing from Coinbase Ventures, Scribble Ventures, DRW Venture Capital, Avenir, and Tiger Global.

Hemson-Struthers described the partnership as “more than capital,” calling it a “powerful validation of our vision to upgrade global payments with stablecoin technology.”

Crypto.news reached out to both BVNK and Visa multiple times, but neither responded by the time of publication.

In the announcement, Visa’s head of growth products and partnerships, Rubail Birwadker, noted that stablecoins “are fast becoming a part of global payment flows, and Visa invests in new technologies and builders like BVNK, staying at the forefront of what’s next in commerce to better serve our clients and partners.”

BVNK claims to process $12 billion in annualized stablecoin payment volume and says it built its platform from the ground up to support automated, high-volume transactions. The firm positions its service as an alternative to the traditional correspondent banking system, which it says is too slow and expensive for many modern business needs.

“At BVNK, we recognized early that stablecoins would emerge as an instant global payment rail and a viable alternative to the traditional correspondent banking system. That’s why we’ve built our infrastructure from the ground up to automate and orchestrate stablecoin payments at scale, making these new rails accessible to businesses of all sizes.”

Hemson-Struthers

Chasing stability

The Visa investment comes at a time when the stablecoin sector is showing signs of broader institutional interest. In late April, Visa partnered with Stripe-acquired Bridge startup to enable fintechs to issue Visa cards that draw directly from stablecoin balances.

The new product, initially launching in six Latin American countries, allows users to fund cards with stablecoins, which are then converted to local fiat at the point of sale. Merchants receive payments in their local currencies, with no exposure to crypto volatility.

Bridge CEO Zach Abrams described the collaboration as a “massive unlock for developers,” adding that everyone “will be able to use stablecoins with just a tap.” Visa’s chief product and strategy officer, Jack Forestell, emphasized that the company aims to “integrate stablecoins securely into its global network,” giving consumers and developers more financial options.

BVNK appears to be part of this broader strategic direction. In its announcement, the company noted that its stablecoin rails could help redefine how businesses operate in the digital economy, particularly in regions with limited access to efficient cross-border banking.

The firm has also been expanding into the U.S. market, opening offices in San Francisco and New York earlier this year. Its U.S. operations are being led by former BlockFi executive Amit Cheela and former Cross River executive Keith Vander Leest.

‘Trillion-dollar opportunity’

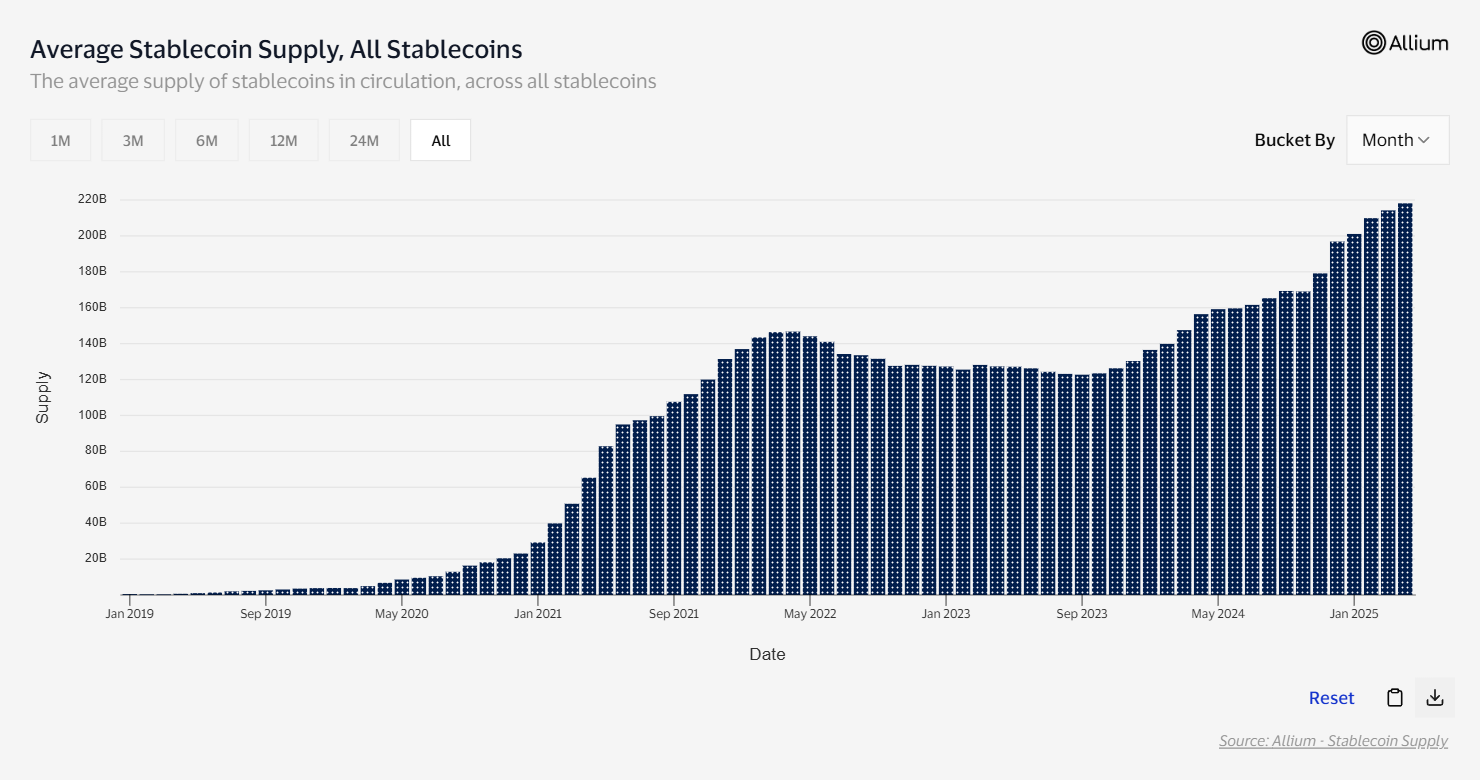

Stablecoin payment volumes have surged in recent quarters. Visa’s Onchain Analytics platform reports $33.4 trillion in global stablecoin volume across 5.5 billion transactions, indicating growing traction beyond trading use cases.

Citi Wealth also noted that stablecoins “could end up reinforcing the U.S. dollar’s dominance,” particularly as stablecoin infrastructure scales globally.

https://twitter.com/hosseeb/status/1874288532686295058

Dragonfly Capital’s managing partner Haseeb Qureshi has earlier also projected that 2025 could mark a turning point for stablecoins, saying they could become key tools for small and medium-sized businesses, moving beyond speculative crypto trading into real-world payments and settlement.

“Stablecoin usage will explode, particularly among SMBs. Not just trading and speculation — real businesses will start using on-chain dollars for instant settlement.”

Qureshi

He also added that efficiency and accessibility would allow stablecoins to outpace traditional systems, especially as regulatory clarity improves.

Pantera Capital, another prominent crypto venture firm, has called stablecoins a “trillion-dollar opportunity,” noting that they now account for over 50% of blockchain transaction activity, compared to just 3% in 2020.

For BVNK, the Visa deal is also a reputational milestone. Hemson-Struthers framed it as a return to first principles in payments innovation.

“I’m particularly excited about what it means to partner with Visa—the original payments innovator,” he said, adding that Visa’s expertise in building global payment networks, combined with BVNK’s stablecoin infrastructure, would create “powerful possibilities.”