Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Pi Network’s massive token release in July may impact prices as XYZVerse gains early traction with strong community momentum.

July brings a significant milestone for Pi Network: a large-scale token release that may influence its price trajectory. What are the implications for investors? We assess the risks and highlight other crypto projects gaining traction amid market shifts.

Market snapshot

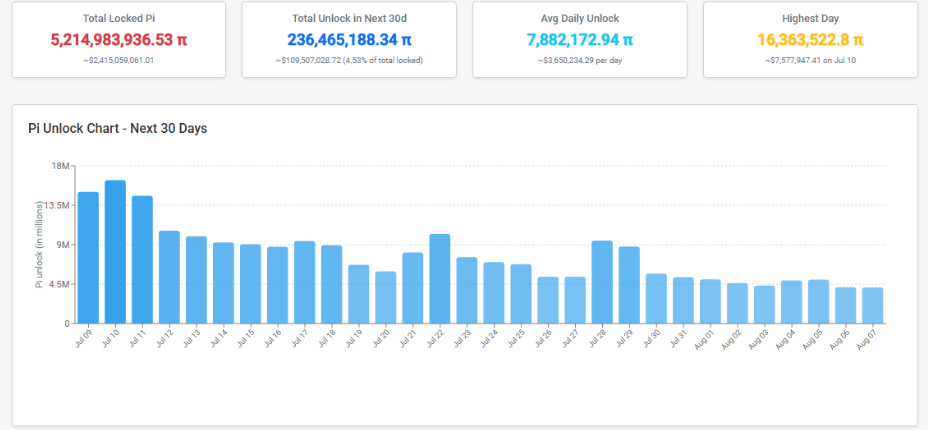

The Pi Network ecosystem faces its most significant test yet. Between July 4 and July 15, the protocol is expected to unlock more than 300 million PI tokens, equivalent to over 4% of its circulating supply. The single largest daily unlock, totaling 19.4 million tokens on July 4, marked the biggest release in Pi’s history.

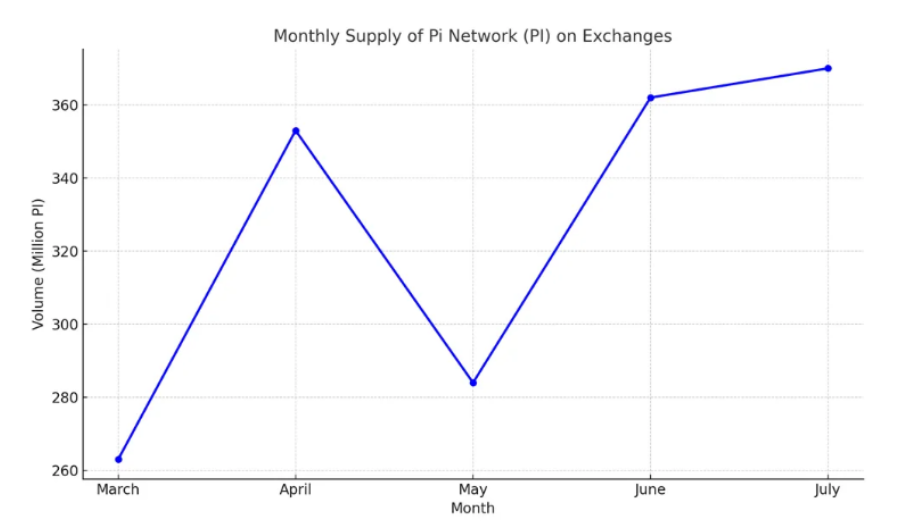

Simultaneously, token reserves on centralized exchanges hit record highs, climbing from approximately 263 million in March to over 370 million in July — a 40% increase in just a few months. Such accumulation indicates institutional-grade sell pressure, with whales increasingly offloading unlocked tokens. On‑chain and OTC markets reflect this tension, despite steady but tepid user activity following new feature rollouts.

Still, there are glimmers of cautious optimism for Pi Network. The recent backing by 137 Ventures, a prominent U.S. venture capital firm with a track record of investing in high-growth companies like SpaceX and Airbnb, has provided a significant credibility boost, signaling institutional confidence in Pi’s long-term potential.

On the technical side, recent backend upgrades have enabled the mainnet migration of over 500,000 users, a notable milestone that enhances the project’s infrastructure and paves the way for broader dApp adoption. These improvements also support Pi’s growing ecosystem, which now includes tools like Pi App Studio and Directory Staking.

However, in the immediate term, these advances may be overshadowed by the ongoing supply shock. The sharp rise in circulating tokens and limited short-term demand drivers, particularly in the absence of major exchange listings, continue to weigh on investor sentiment. While the foundation is being strengthened, the market’s focus remains fixed on liquidity and price resilience in the weeks ahead.

PI price technical outlook

Pi Network is currently trading in the $0.45 to $0.50 range, reflecting a 35% decline from its May high. This pullback coincides with mounting market pressure ahead of the July token unlock, and several key technical indicators suggest that further downside is likely in the short term.

The Relative Strength Index (RSI) hovers around 41, indicating weakening momentum and approaching oversold territory. At the same time, the MACD has confirmed a bearish crossover, reinforcing the view that sellers are currently in control.

From a price structure perspective, support levels sit at $0.40 and $0.35, with the latter being a critical threshold. On the upside, resistance lies at $0.53 and $0.60, and would need to be reclaimed to signal any meaningful bullish recovery.

Is Pi Network entering a bearish phase?

Given the heavy token unlocks and rising exchange reserves — now at record highs — continued sell pressure remains the dominant risk. If this trend persists, a retest of the $0.35–$0.38 zone appears highly probable.

- Short-Term: Expect continued price pressure. Unless emergency liquidity or exchange listings occur, PI faces the risk of retesting $0.35–$0.40. The large unlock and increasing exchange reserves threaten to overshadow positive fundamentals.

- Mid- to Long-Term: Holders should look for signs of ecosystem traction, Pi App Studio’s AI tool builder, identity dApps, and domain features could begin driving real usage. That said, liquidity remains limited on major CEXes, limiting recovery potential absent broader adoption or listings.

- Market Context: In comparison to broader crypto, where assets like Bitcoin and Ethereum are seeing renewed institution-led inflows, Pi functions as a specialized micro‑cap — subject to both idiosyncratic risk and opportunity.

However, for mid- to long-term holders, the outlook isn’t entirely bleak. Ecosystem developments such as Pi App Studio, identity infrastructure, and the integration of staking and dApps may support gradual recovery, provided they translate into real user activity and token demand.

For investors looking to diversify amid Pi’s turbulence, one rising star is XYZVerse.io, a memecoin designed to merge sports betting, gamified staking, and social virality.

Alternative play: XYZVerse is gaining momentum

XYZVerse (XYZ) is one of the most dynamic new memecoins in 2025, blending sports culture, web3 utility, and community engagement into a cohesive ecosystem.

Unlike many mainstream crypto projects now largely driven by macro market cycles, XYZVerse is still in its early-stage growth phase, fueled by grassroots community support and strong presale momentum. Rather than riding existing market waves, it’s building its own.

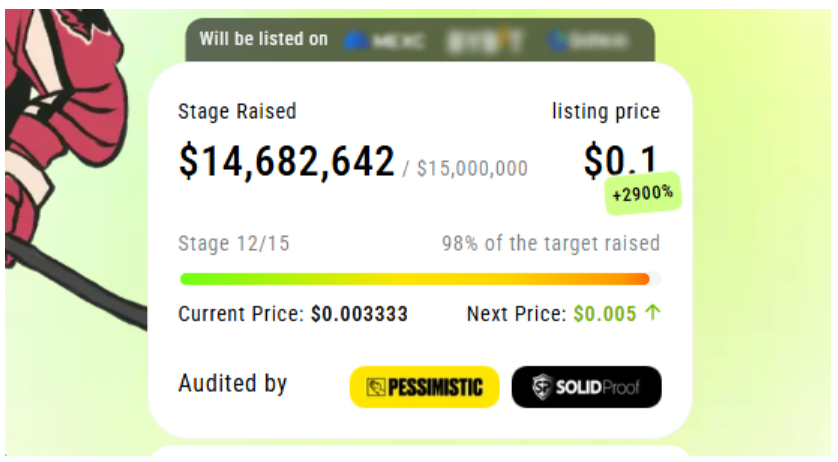

Massive presale momentum: Nearly $15M raised

Launched amid a bear market, XYZVerse quickly captured investor attention through a transparent, tiered presale structure that rewards early entry. As market sentiment shifted bullish, the project’s growth accelerated:

- Current Presale Stage: 12 out of 15

- Presale Price Range: From $0.0001 to $0.003333

- Final Presale Target: $0.02, offering early backers a discount of up to 99.9%

- Post-Listing Target: $0.10, representing a potential 30× return from current levels

This level of structured early access is increasingly rare in today’s memecoin space, which is saturated with hype-driven launches and unsustainable tokenomics. XYZVerse stands out by combining early-mover potential with long-term vision and token utility.

Community-driven growth and real-world partnerships

XYZVerse has quickly built a loyal and rapidly expanding community, with over 21,000 followers on X (formerly Twitter) and 12,000+ active Telegram members. This grassroots momentum has been a key driver of its early success, fueling organic marketing and presale demand. The project’s strong engagement and transparency earned it the title of “Best New Meme Project” by CryptoNews, further validating its position in the next generation of meme-based crypto assets.

Beyond community hype, XYZVerse has also formed a strategic partnership with bookmaker.XYZ, integrating real-world sportsbook features directly into its ecosystem. This collaboration enables token holders to access exclusive betting perks, adding tangible utility and reinforcing the project’s unique bridge between crypto, entertainment, and sports culture.

Key features and user benefits:

- Airdrops through the Ambassador Program and ongoing community campaigns

- Play-to-earn Telegram games and upcoming dApps with real token rewards

- Free betting perks and special access via bookmaker.XYZ for token holders

- Deflationary model with buybacks and token burns to support long-term value

Final thoughts

The July token unlock wave may test Pi Network’s price resilience. While its long-term fundamentals remain promising, short-term volatility could lead to further downside. Investors should monitor key levels and macro sentiment closely.

In parallel, exploring well-positioned early-stage tokens like XYZVerse offers a strategic way to balance risk and capture potential upside, especially in a market environment increasingly shaped by narratives and community-driven growth.

To learn more about XYZVerse, visit the official website, Telegram, and Twitter.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.