Solana experienced a short-lived rally following confirmation that the first-ever Solana ETF featuring staking capabilities is scheduled to launch on July 2, 2025.

According to data from crypto.news, Solana (SOL) surged nearly 6% to an intraday high of $158.30 on Monday before paring gains and settling around $152.60 at press time. Despite the retracement, the token remains approximately 44% above its year-to-date low, with a current market capitalization exceeding $81.6 billion.

SOL’s rally was driven by renewed investor hype surrounding the upcoming exchange-traded fund launch set to go live tomorrow. The product, branded as the REX-Osprey SOL + Staking ETF, will be the first in the U.S. to offer on-chain staking rewards alongside spot price exposure. It marks a notable departure from previous crypto ETFs that have largely excluded staking features due to regulatory and structural constraints.

However, the early excitement faded quickly as investors began to temper their expectations about how successful the new Solana ETF might be.

A key reason for this skepticism is the relatively small size of Grayscale’s Solana Trust (GSOL), which has been around for over 43 months but only manages about $75 million in assets, a stark contrast to Grayscale’s Ethereum Trust (ETHE) which had amassed $10 billion in assets just a month before the spot Ethereum ETF launched in July 2024.

Traders seem increasingly uncertain, as derivatives data also points to weakening momentum for the sixth-largest crypto asset by market cap.

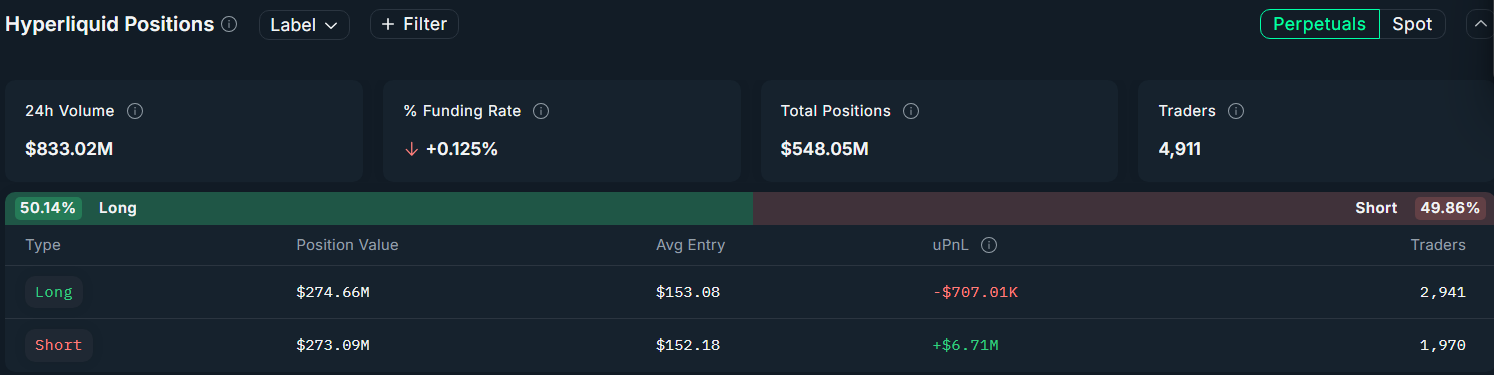

Solana’s perpetual futures market on Hyperliquid reveals a cautious stance among traders. While long positions slightly outweigh shorts in volume, the profit lies with the bears; that is, shorts are currently up by over $6.71 million, while longs are collectively down more than $707,000.

This disparity suggests that many longs bought in during the ETF hype and are now underwater, reinforcing a cautious near-term outlook.

Further, the market cap of stablecoins on the Solana network has fallen from $13 billion in April to around $10.5 billion as of press time, indicating a notable decline in on-chain liquidity and reduced demand for transactional activity within the ecosystem.

On top of that, despite the recent hype surrounding Solana memecoins, the network’s revenue has declined by over 90% since January.

All these factors could likely continue to weigh on Solana’s performance despite the ETF news.

Solana price analysis

On the 1-day/USDT chart, Solana (SOL) is pulling back toward the descending trendline it broke earlier, the same level that sparked today’s rally. If it falls back below this line, it could signal a trend reversal and bring back bearish momentum.

Price action has also slipped below the 50-day simple moving average, a commonly observed dynamic support level. This breakdown signals fading short-term strength and adds to the bearish technical outlook.

The Relative Strength Index, which initially rose to 55 after the ETF news broke, has fallen back to 51 at the time of writing, indicating that the initial buying pressure has faded.

Given these technical signals, SOL appears poised to retest support at $143.10, which aligns with the 23.6% Fibonacci retracement level. A decisive break below this level could open the path toward deeper downside, with the next key support resting at $126.48, its local low from last month.

A bearish overhang for SOL investors is that over $585 million worth of SOL will be unstaked in the next two months, which could potentially increase selling pressure and weigh further on price performance.

Still, in a market where perception often outweighs fundamentals, strong day-one flows into REX-Osprey SOL + Staking ETF could override technical weakness and drive renewed accumulation.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.