Chainlink price has crashed in the past few months, mirroring the performance of most altcoins.

Chainlink (LINK), the largest oracle in the cryptocurrency industry, trades at $13.12, down 26% from its highest point in May and 57% lower than its November high.

LINK has crashed despite having some notable news in the past few weeks. For example, Chainlink launched a major partnership with Mastercard, the second-biggest payment processor globally.

This partnership will enable people to buy crypto directly using their cards, with Chainlink providing verification and synchronization solutions. The partnership also included companies like Shift4 Payments and Uniswap (UNI).

Chainlink is also expected to play a major role in the booming stablecoin industry through its Proof of Reserve solution. This solution helps companies provide accurate data on their holdings.

Meanwhile, the company has continued to ink partnerships with some of the biggest companies globally. It now has partnerships with companies like JPMorgan, UBS, Swift Network, and ANZ Bank.

In a statement today, July 2, the company said that it was partnering with Aktionariat, an equity tokenization platform with over 30,0000 registered investors. The Swiss company is using its Cross-Chain Interoperability Protocol to enable secure, cross-chain treasury accounts.

Chainlink also joined the xStocks Alliance, becoming the official oracle provider. Other companies in the alliance are Kraken, Solana, Alchemy Pay, Jupiter, and Raydium. Its Oracle solutions will enable tokenized stocks to be available to investors globally.

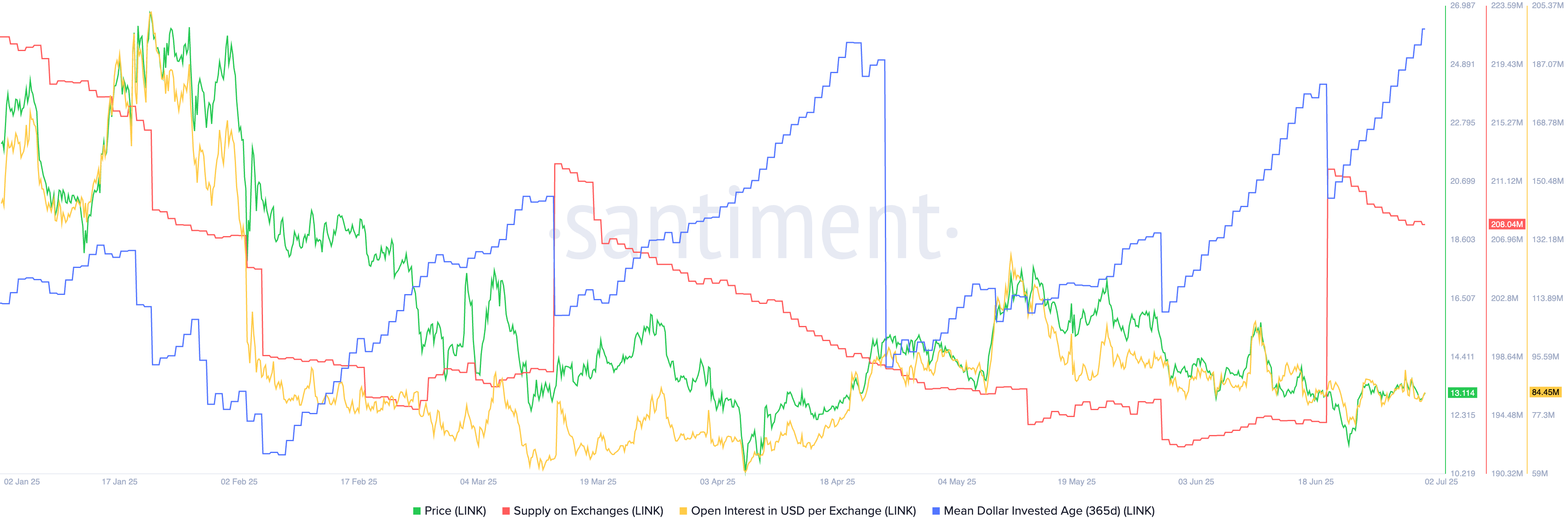

On-chain data is also bullish on Chainlink. For example, Santiment data shows that there are now 208 million LINK tokens on exchanges, down from 212 million last month. This decline is notable because it comes after the volume surged in June.

Also, the Mean Dollar Invested Age or MDIA has continue soaring this year, reaching a high of 129.50, up from a low of 110 in April. The rising MDIA indicator is a sign that investors continue to hold their tokens.

Chainlink price technical analysis

The daily chart shows that the LINK price is sending mixed signals on what to expect. On the positive side, the token has formed a double-bottom pattern at $10.9 and a neckline at $17.90.

A double bottom is a highly accurate bullish sign in technical analysis. If this happens, the initial target to watch will be at $17.90, followed by the psychological point at $20.

On the other side, the token remains below the 50-day and 100-day Exponential Moving Averages, a sign that the bearish trend is intact. It has also formed an inverse cup-and-handle pattern, with the current phase being the handle section.

If this pattern is an inverse C&H instead of a double-bottom, it means that the price will continue falling, potentially to $10.

Therefore, the key level to watch will be $10.91, the double-bottom or the lower side of the inverse C&H. A break below that level will confirm the bearish breakdown and point to further downside.